Advertisement

Advertisement

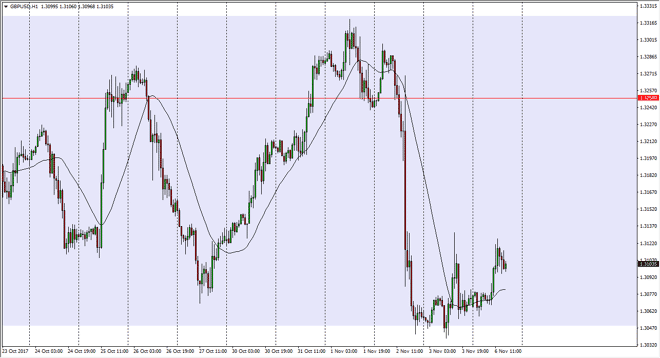

GBP/USD Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 07:00 GMT+00:00

The British pound rallied a bit during the session on Monday, bouncing from the 1.3050 region. This is an area that defines the bottom of recent

The British pound rallied a bit during the session on Monday, bouncing from the 1.3050 region. This is an area that defines the bottom of recent consolidation, so it’s not a huge surprise that we were to bounce from there. If we were to rally from here, I suspect that the 1.3250 level will be the initial target. That level has been of interest by currency traders for some time, and I would be more than willing to take profit at that point. This is because I don’t see anything to break the consolidation in the short term, and I recognize that there is a significant amount of support underneath. Ultimately, the 1.30 level underneath should continue to be an area worth watching, as it is a confluence of not only horizontal support, but also an uptrend line. If we were to break down below there, it is a market moving event that should send this market to the downside.

The alternate scenario of course is a continuation of the overall consolidation, which is something that I suspect we will continue to see that. If we were to break above the 1.33 handle, then we are free to go to the 1.35 level beyond that. I think that the British pound will continue to be very volatile, because on one hand we have inflationary pressures showing up in the United Kingdom, but there are a lot of concerns about what’s going to happen down the road as leaving the European Union is a bold move. I think we will continue to see a lot of volatility, but overall, I think eventually the buyers will step into the market and try to continue to the upside. I do not think that happens in the short term though, and therefore patience will be needed to build larger positions.

GBP/USD Video 07.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement