Advertisement

Advertisement

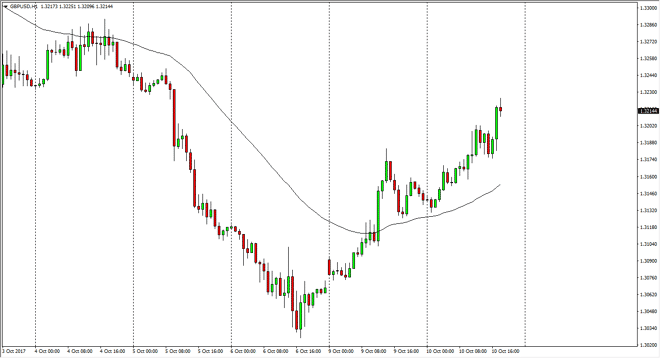

GBP/USD Forecast October 11, 2017, Technical Analysis

Updated: Oct 11, 2017, 05:25 GMT+00:00

The British pound rallied against the US dollar on Tuesday, as the 24-hour exponential moving average continues to offer dynamic support. Breaking above

The British pound rallied against the US dollar on Tuesday, as the 24-hour exponential moving average continues to offer dynamic support. Breaking above the 1.32 level is of course a good sign, and I think we may go looking towards the 1.3250 level. The market will be paying attention to the FOMC Meeting Minutes during the day today, and any signs of dovish this coming out of the Federal Reserve could turbocharge this move higher. I think that eventually the buyers continue to push the British pound higher either way, as the Bank of England looks almost certain to raise interest rates. However, the 1.30 level below being broken to the downside would be a very negative sign. Recently, we have seen a lot of bullish pressure, so the significant pullback probably should not have been much in the way of a surprise.

The 1.3650 level above is where the market gapped lower after the surprise to leave the European Union, and I think this recent pullback has been an attempt to build up enough momentum to finally break out to the upside. I do not think that it happens immediately, and I think that it will take several attempts to get above that level. Once we do, this becomes more of a buy-and-hold market. That might be the theme of the fall in this pair: trying to build up enough momentum to break out. In the meantime, I like buying pullbacks, but I also recognize that the volatility is going to be extreme so small position sizing might be the best way to go, gradually adding us things going your favor. If we break down below the 1.30 level though, then I think the market goes looking for support at the 1.2850 level underneath.

GBP/USD Video 11.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement