Advertisement

Advertisement

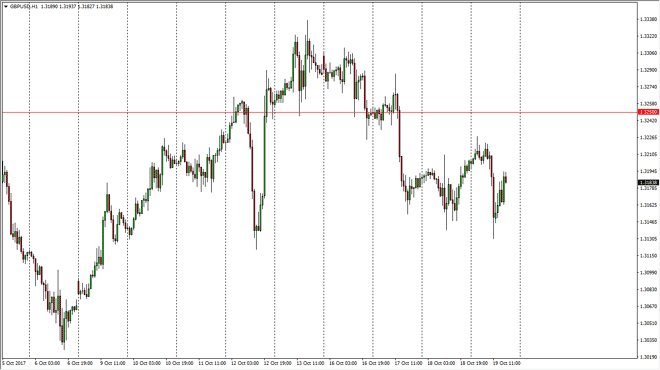

GBP/USD Forecast October 20, 2017, Technical Analysis

Updated: Oct 20, 2017, 05:55 GMT+00:00

The GBP/USD pair initially went sideways on Thursday, then fell towards the 1.3150 level, where we found buyers and have now turned around to show signs

The GBP/USD pair initially went sideways on Thursday, then fell towards the 1.3150 level, where we found buyers and have now turned around to show signs of strength again. Because of this, the market looks very likely to continue to grind overall, but I think that the 1.3250 level above is going to be the short-term target. If we can break above there, then we will have formed a “W pattern” on the hourly chart, and that we should continue to go higher from there. I think that the 1.3150 level is minor support, and therefore if we break down below there we will probably go looking towards the 1.30 level underneath. Overall, this is a market that should continue to see a lot of noise, but once we get the ability to make a clear move, I think it will be sudden as is typical in the British pound.

Remember, the British pound is highly sensitive to the headlines coming out of the negotiations between Brussels and London, which is a very volatile situation. Sudden moves in the currency market can be expected, as we don’t know what’s going to be said next, or more importantly, what traders are going to react to. Because of this, I find the pair to be very difficult to deal with, but longer-term I believe that the Bank of England will raise interest rates, and send this market looking towards the 1.3650 level above. Once we break above there, becomes more of a buy-and-hold situation as that was the scene of the gap down from the boat believe the European Union. Until then, I think we will continue to see a lot of choppiness, and therefore it’s going to be almost impossible to deal with this type of noise for larger positions.

GBP/USD Video 20.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement