Advertisement

Advertisement

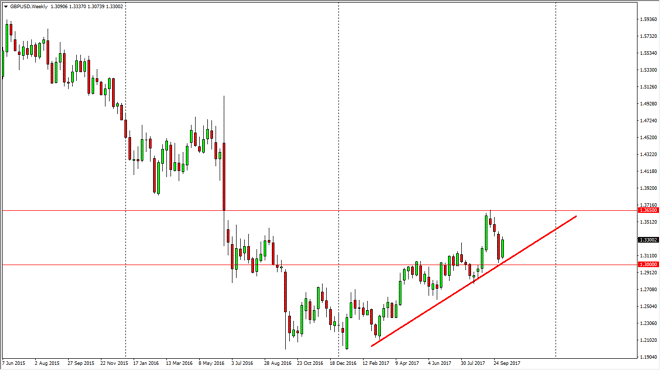

GBP/USD forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:31 GMT+00:00

The British pound rallied significantly during the week, bouncing from the uptrend line that you see on the weekly chart. The uptrend line intersected

The British pound rallied significantly during the week, bouncing from the uptrend line that you see on the weekly chart. The uptrend line intersected near the 1.30 level, so it makes perfect sense. We continue to have a lot of noise above at the 1.3650 level above, as it was where the market gapped after the vote to leave the European Union. This is going to be very difficult to break above, but once we do, the British pound son let becomes a “buy-and-hold” currency. I believe that a break above the top of the weekly candle for this past week is reason enough to go long, and I also recognize that we will more than likely need to attempt a breakout several times to build up the necessary momentum to smasher that resistance. The uptrend line is still very much intact, so as long as that’s the case, I don’t see any way to short this market.

If we break down below the 1.30 level underneath, and that is a very negative sign, and changes everything. However, I think this past week has shown that we are ready to continue going higher, and as a result I think that the British pound is continuing to see a bit of a renaissance when it comes to the currency markets as the Bank of England looks likely to raise interest rates over the longer term. Ultimately, once we do breakout to the upside, I expect that the momentum picks up, and that the British pound completely wiping out the losses from the surprise vote would be an extraordinarily bullish sign, and more money would come flooding into the market to accelerate the move to the 1.45 handle. Is going to be noisy, but if you are patient enough it should be profitable.

GBP/USD Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement