Advertisement

Advertisement

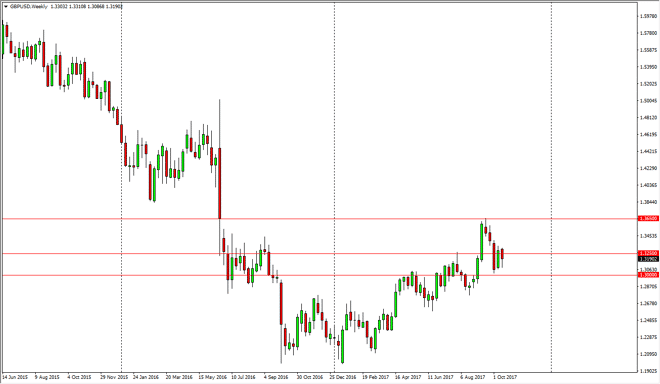

GBP/USD forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:21 GMT+00:00

The British pound spent a great deal of the week falling, slicing through the 1.3250 level, and then aiming towards the 1.31 level underneath. However,

The British pound spent a great deal of the week falling, slicing through the 1.3250 level, and then aiming towards the 1.31 level underneath. However, there was a bit of support in that area, and I certainly think that the 1.30 level is massively supportive. Because of this, it’s likely that the market will continue to find buyers, as we have formed a bit of a hammer. Because of this, the market is likely to eventually rally, and a break above the top of the candle should send the market looking towards the 1.3650 level above. That was the scene of the gap lower after the surprise vote to leave the European Union, so I think it’s can be difficult to break above there. However, it is likely that we will attempt to get above there eventually. That area being broken above could send this market to the 1.40 level, and then the 1.48 level after that. I think that pullbacks offer value, and if we can stay above the 1.30 level, it’s likely that there will be no helping but going to the upside.

With the Bank of England likely to raise interest rates, it makes sense that the British pound will continue to see bullish pressure, and of course there is a bit of an uptrend line just underneath, which of course keeps the market so bullish and of course somewhat supported. I think that we will continue to grind to the upside, more than anything else. It will be difficult to deal with the noise, but if you are longer-term investor, it’s likely that this could work out quite nicely. Start out with small positions, and then add to them as the trade goes in your favor.

GBP/USD Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement