Advertisement

Advertisement

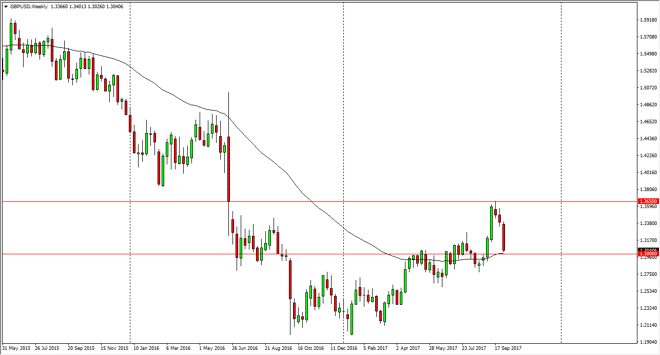

GBP/USD forecast for the week of October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:29 GMT+00:00

The GBP/USD pair broke down significantly during the week, slicing down to the 1.30 level. That’s an area that of course is important due to the large,

The GBP/USD pair broke down significantly during the week, slicing down to the 1.30 level. That’s an area that of course is important due to the large, round, psychologically significant number. I think that the markets will find buyers in this general vicinity, but if we were to break down below the 1.29 level, the market would collapse and perhaps reach towards the 1.25 handle, and possibly the 1.21 level. This is a market that is currently dealing with the inability of the Teresa May government to get it together when it comes to the negotiations out of the European Union. Because of this I think that there is going to be a certain amount of negativity around the British pound, but I can also make an argument for an uptrend line just below. If we do rally from here, I expect this market to go looking towards the 1.3650 level above, which is where we had gapped lower on the charts from the surprise vote to leave the European Union.

If we do break above there, and I think we will someday, that becomes a longer-term “buy-and-hold” move. Having said that, I think that the market has a lot of work to do to get to that point. If we did breakdown below the 1.29 level, I think that the move lower could be a bit of a “washout”, or what is also known as a capitulation. That would be a very sudden move, but at that point value hunters would come back into the marketplace to look for value in the British pound itself. The Federal Reserve looks likely to raise rates, but then again, so does the Bank of England. I think this is more of a political move than anything else.

GBP/USD Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement