Advertisement

Advertisement

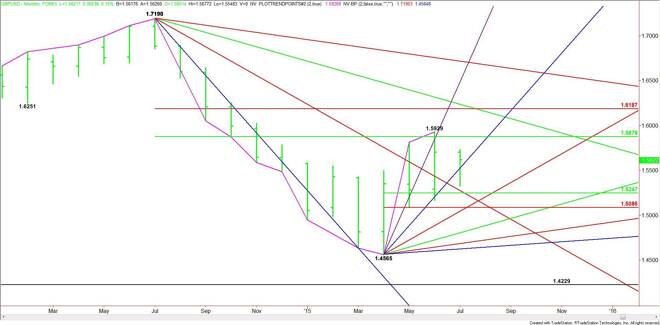

GBP/USD Monthly Technical Analysis for August 2015

By:

The GBP/USD finished lower in July, but well off its lows. It also posted an inside move, which suggests trader indecision and impending volatility. After

The GBP/USD finished lower in July, but well off its lows. It also posted an inside move, which suggests trader indecision and impending volatility.

After weakness early in the month, the Forex pair rebounded after a few Bank of England members mentioned the need for higher interest rates. BoE Governor Mark Carney has also been preparing homeowners for a possible rate hike. Late in the month, the second quarter GDP report came out as expected but well above the first quarter reading. This was a sign of a strengthening economy.

Traders should look for volatility during the first week of the month. The Bank of England’s interest rate decision on August 6 could influence the market the rest of the month. This same day, the government will release its latest quarterly inflation report.

Signs of a greater dissent within the Monetary Policy Committee (MPC) are also strong indications that rates are set to move higher before the end of the year. There growing speculation that MPC members Martin Weale and Ian McCafferty will push for a rate hike sooner-rather-than-later. This will certainly provide support for the British Pound. However, another unanimous vote to keep rates at historical lows could trigger a resumption of the downtrend.

Adding fuel to the fire this week will be Friday’s U.S. Non-Farm Payrolls report. Traders are currently pricing in a 224K increase. A number well above this figure will be bullish for the U.S. Dollar because it will likely mean the Fed will hike rates in September. A number well below the estimate will likely mean a rate hike will be taken off the table until December.

Look for volatility this month because there is a race between the BoE and the Fed as to which central bank will raise first. The interest rate differential will shift in the direction of the rate hike, making that currency a more attractive investment.

Technically, the main trend is down according to the monthly swing chart. The main range is 1.7190 to 1.4565. Its retracement zone at 1.5878 to 1.6187 is the primary upside target of the current rally. In June, this zone stopped the rally at 1.5929.

The short-term range is 1.4565 to 1.5929. Its retracement zone at 1.5247 to 1.5086 is the primary downside target.

The first important angle to follow comes in at 1.5845. A sustained move over this angle will put the market in a strong position.

The next key angle passes through the support zone at 1.5205. This makes 1.5247 to 1.5205 a key support cluster.

Look for increased volatility during the first week of August. Both the BoE interest rate decision on August 6 and the U.S. Non-Farm Payrolls report on August 7 should exert tremendous influences on the market.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement