Advertisement

Advertisement

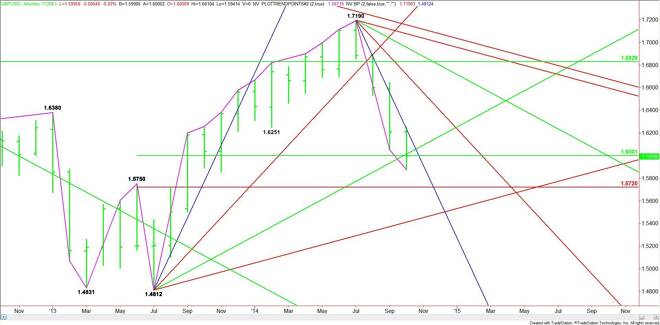

GBP/USD Monthly Technical Analysis for November 2014

By:

The GBP/USD fell for a fourth month, as traders pushed back expectations of the timing of a Bank of England rate hike amid signs of a slowing economic

The GBP/USD fell for a fourth month, as traders pushed back expectations of the timing of a Bank of England rate hike amid signs of a slowing economic recovery. The four-month decline is the longest downward trend since March 2010.

The catalyst behind the weakness was weak economic data including U.K. mortgage approvals which fell for a third month and slowing home prices. Demand for the dollar also increased as the U.S. Federal Reserve ended its bond-purchase program while citing an improving U.S. labor market in its recent Federal Open Market Committee monetary policy statement.

The Bank of England left its benchmark interest rate unchanged as well as its stimulus. Traders also reacted negatively to BOE Deputy Governor Jon Cunliffe who said the central bank will keep rates low and continue to provide stimulus as long as it can while keeping inflation in check.

The BOE’s next Monetary Policy Committee to decide interest rates is on November 6.

Technically, the GBP/USD is currently testing a major retracement area. The main range is 1.4812 to 1.7190. Its retracement zone is 1.6001 to 1.5720. Last month, the Sterling took out the upper or 50% level at 1.6001 on its way to 1.5874, but quickly traded back to it into the close.

This month, the market is set to open on the strong side of a downtrending angle at 1.5910 and on the bearish side of an uptrending angle at 1.6092. Look for an early downside bias as long as the market stays below the 50% level at 1.6001.

Overtaking 1.6001 will indicate some light short-covering, but overcoming 1.6092 will indicate the buying is getting stronger. There is room to the upside over this price.

A sustained move under 1.6001 will be a sign of weakness, but don’t expect an acceleration to the downside unless 1.5874 fails as support.

If volatility is high, the extreme targets this month are 1.6550 on the upside and 1.5720 on the downside.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement