Advertisement

Advertisement

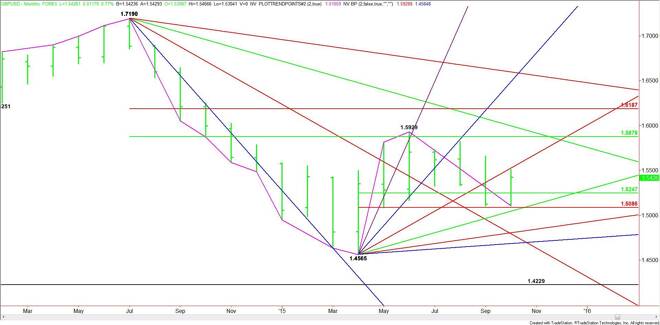

GBP/USD Monthly Technical Analysis for November 2015

By:

The GBP/USD overcame early month weakness to close higher in October. A weaker than expected U.S. Non-Farm Payrolls report in early October helped put in

The GBP/USD overcame early month weakness to close higher in October. A weaker than expected U.S. Non-Farm Payrolls report in early October helped put in the bottom because it convinced investors that the Fed would likely postpone a rate hike until at least March 2016.

Late in the month, the Fed issued a hawkish monetary policy statement that increased the probability of a December rate hike. This initially weakened the British Pound, but a series of weaker-than-expected U.S. economic reports helped drive the Sterling higher into the close. The GBP/USD finished October at 1.5426, up 0.0300, or 1.98%.

Also support the Forex pair late in the month was speculative buying tied to the possibility the Bank of England would raise interest rates before the Fed.

The tone of the market could be determined early this month with the Bank of England monetary policy committee set to meet on November 5 and the U.S. Non-Farm Payrolls report on November 6.

The primary focus early this month will be on the BoE’s monetary policy statement on Thursday, November 5 also known as “Super Thursday”. The BoE is widely expected to keep interest rates unchanged at a record low of 0.50%. However, investors should look for increased volatility because the central bank is also expected to release its update quarterly Inflation report. BoE Governor Mark Carney is also scheduled to speak. He is expected to continue to prepare businesses and households for higher borrowing costs.

Late last month, the U.S. Federal Reserve said, “In determining whether it will be appropriate to raise the target range at its next meeting, the committee will assess progress – both realized and expected – toward its objectives of maximum employment and 2 percent inflation.”

The Fed also dropped a warning on global economic slowdown, a step which some believe, brings the central bank closer to a rate hike. The hawkish Fed statement raised the probability of a rate hike in December to 50 percent, up from 30 percent before the statement, according to the Fed Funds futures contract.

Based on the Fed’s statement, this month’s Non-Farm Payrolls report for November will be watched closely. Hawkish investors will be looking for it to bounce back from last month’s dismal numbers. The focus will not be on the headline number, but on the Average Hourly Earnings, which are expected to show a rise of 0.2%.

Technically, the main trend is down according to the monthly swing chart. The main range is 1.4565 to 1.5929. Its retracement zone is 1.5247 to 1.5086. This zone has provided support the last two months and will remain support this month along with a short-term uptrending angle at 1.5125.

Based on the close at 1.5426, the first upside target is a steep uptrending angle at 1.5685. A sustained rally over this angle will indicate the presence of buyers with the next objective over the near-term, a major 50% level at 1.5878.

On the downside, a failure to hold the Fibonacci level at 1.5086 could trigger the start of a steep break.

Look for a bullish tone this month if the Bank of England is hawkish with its inflation forecast and the U.S. labor market continues to fall short of expectations. A bearish tone will develop if the Bank of England is dovish and the U.S. labor market continues to meet expectations along with improving consumer inflation.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement