Advertisement

Advertisement

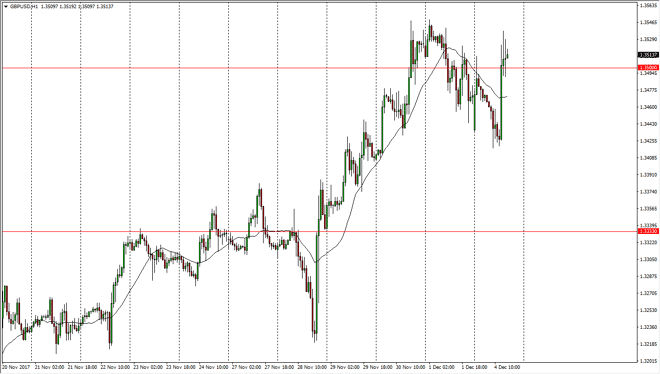

GBP/USD Price Forecast December 5, 2017, Technical Analysis

Updated: Dec 5, 2017, 05:56 GMT+00:00

The British pound continues to be very interesting, as we have seen quite a bit of volatility. Ultimately, it looks as if the buyers are starting to get aggressive, so it will be interesting to watch this pair over the next several sessions.

The GBP/USD pair initially gapped lower at the open on Monday, and then bounced enough to slam into the 1.35 handle. We pulled back from there to test the 1.3425 level underneath, and then exploded to the upside again. Now that we are over the 1.35 handle for the second time during the session, I suspect that it’s only a matter of time before we get enough momentum to break out. I think once we do break to a fresh, new high, we will more than likely make a significant test of the 1.3650 level above, which was a gap lower from the surprise vote coming out of the UK. A break above that turns the British pound into an investment, and not a trade anymore. In other words, it’s a “buy-and-hold” situation just waiting to happen.

Ultimately, when we pull back I’m looking for buying opportunities in this pair, as the British pound certainly seems to be doing quite well. That doesn’t mean that we won’t get the sudden volatile moves in both directions, so because of this I would keep my trading positions relatively small, because headlines will certainly be moving this pair occasionally. I think that the 1.3333 handle underneath now becomes the “floor” in the market, and you will be forced to pay attention to the longer-term outlook for this market, and maybe not so much the short-term noise. The US dollar will of course have its influence as well, but I think for the most part we are basically paying attention to the British pound when it comes to this market.

GBP/USD Video 05.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement