Advertisement

Advertisement

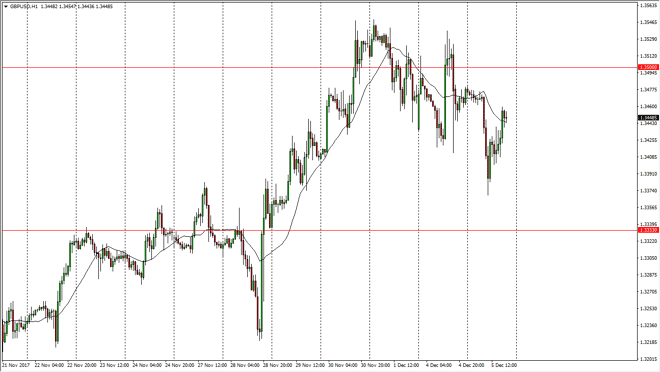

GBP/USD Price Forecast December 6, 2017, Technical Analysis

Updated: Dec 6, 2017, 07:01 GMT+00:00

The British pound continues to be very volatile, as we have dipped significantly after it was announced that there was no agreement between the UK and EU quite yet. However, we have recovered later in the day.

The British pound continues to be very volatile, dropping after Teresa May said that there was no agreement between the UK and the EU yet. However, she remained upbeat, and eventually they will make some type of decision. On the other side of the Atlantic Ocean, we have the likelihood of tax reform which helps the US dollar, so it makes sense that we had to pull back a little bit during the session. However, longer-term I do believe that the buyers are going to jump into this market, and reach towards the 1.35 handle again. Because of this, I like the idea of buying these pullbacks slowly, and building up a larger position as we go looking towards the 1.3650 level over the longer term. The market has been very noisy lately, but that makes sense as we are trying to figure out where the UK goes from here.

I believe that the 1.3333 level is a bit of a “floor”, and should keep this market supported. Ultimately, if we break down below there it would disrupt the entire thesis of the British pound breaking out eventually. I think that this will be a volatile couple of months, but if we get an agreement between the United Kingdom and the EU, unless it’s horrific for the United Kingdom, it should send the value of the pound much higher as it offers the one thing traders desperately one: certainty. A breakdown below the 1.3333 handle would of course be the opposite, perhaps send in the market down to the 1.30 level. My base case scenario is that we will eventually break above the 1.3650 level, and become a “buy-and-hold” market.

GBP/USD Video 06.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement