Advertisement

Advertisement

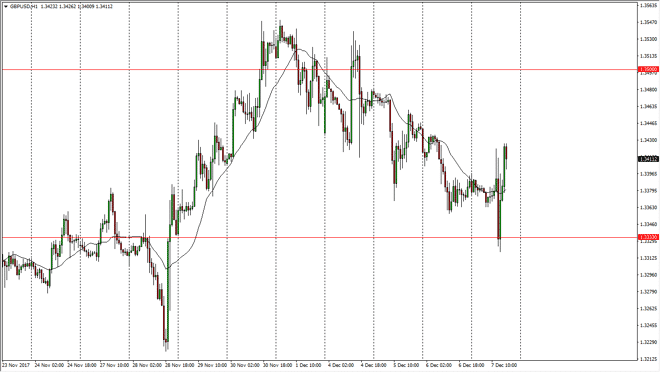

GBP/USD Price Forecast December 8, 2017, Technical Analysis

Updated: Dec 8, 2017, 06:31 GMT+00:00

The British pound initially fell during the trading session on Thursday, testing the 1.3333 handle, before bouncing later in the day to rally yet again.

During the trading session on Thursday, we initially fell to the 1.3333 level, but then bounced rather significantly from this massive area of importance, especially due to not only structural support, but the agreement on the European Court of Justice between the UK and the EU. While the complexities of that agreement are beyond the scope of this article, it is yet another hurdle that the market has overcome. Because of this, I suspect that we are going to go looking towards the 1.35 handle above, which of course will be resistive. Longer-term, I believe that the British pound is making a serious go at the previous ceiling in the market near the 1.3650 level. A break above there is a “buy-and-hold” scenario, and should continue to be an opportunity to take advantage of what should be a longer-term move. After all, the British pound was priced in for Armageddon, and as time goes along traders are starting to understand that the United Kingdom will survive leaving the European Union. As usual, markets have overreacted, and I think at this point we are starting to see exactly how much.

If we were to break down below the 1.3333 handle, then I think we would probably drop down to the 1.30 level underneath, which of course is a large, round, psychologically significant number. In general, I am a buyer of this market, and although volatile, I suspect that adding slowly will probably benefit the long traders. On a break out to the upside, I suspect we are looking at 1.40, an area that should be of significance.

GBP/USD Video 08.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement