Advertisement

Advertisement

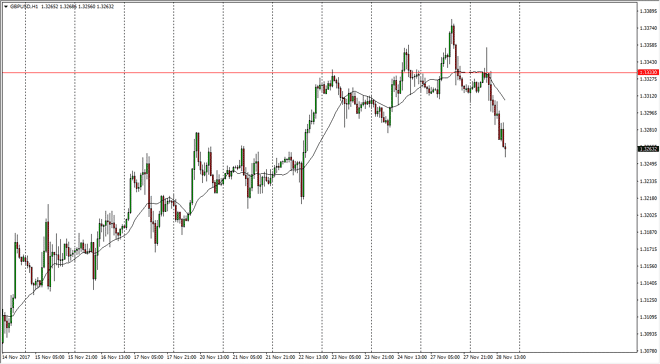

GBP/USD Price Forecast November 29, 2017, Technical Analysis

Updated: Nov 29, 2017, 09:40 GMT+00:00

The British pound initially tried to rally during the trading session on Tuesday, but found the area above the 1.3333 level to be a bit too expensive.

The British pound initially tried to rally during the trading session on Tuesday, but found the area above the 1.3333 level to be a bit too expensive. Because of this, I think that the pullback to the 1.3250 level makes a lot of sense, and this was an area where we had seen a bit of resistance in the past. I think that we could find buyers in this area, perhaps reaching towards the 1.3333 handle again. If we were to break down below the 1.32 handle, the market will probably drop down to the 1.30 level over the next several sessions. Ultimately, I do think that this market breaks out, but the pullback is probably necessary to build up the momentum that the market needs to break above when I feel is the prize: the 1.3650 level above as it is the gap from the surprise announcement that the United Kingdom voted to leave the European Union.

This gives us an opportunity to buy the British pound on pullbacks as it offers value, and the British pound is historically cheap against the US dollar. Alternately, if we were to break down below the 1.30 level underneath, the market would probably fall rather significantly. I think this would take some type of surprise announcement to come out, and I believe that given enough time we will probably find reason enough for the British pound to rally against the US dollar, maybe in the form of the US Congress not being able to pass significant tax reform. It seems as if the US Congress has become even more dysfunctional than usual over the last couple of months, and with a lack of tax reform, that will be very negative for the US dollar.

GBP/USD Video 29.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement