Advertisement

Advertisement

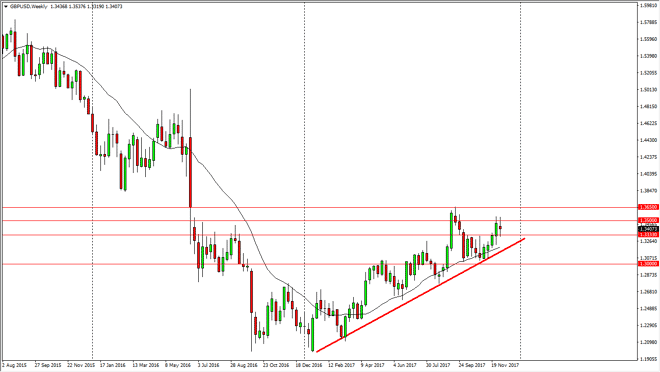

GBP/USD Price forecast for the week of December 11, 2017, Technical Analysis

Updated: Dec 9, 2017, 08:09 GMT+00:00

GBP/USD continues to be very volatile as we work our way through the negotiations, but I believe that longer-term we have rather bullish pressure that should eventually causes market to break out.

The British pound has been very choppy over the week, breaking above the 1.35 level initially, but then rolled over to form a slightly negative candle. This is an area that we have seen a lot of activity, as the 1.3333 level was previously resistive, and now has become supportive. There is also a nice uptrend line underneath that we can follow, so I think that if you are patient enough, you should find plenty of reason to go long. I don’t think this is a market that is easily shorted, least not until we break down below the 1.31 handle on the longer-term charts. When I look at this chart, it’s not difficult to imagine an uptrend in channel that we have been forming all year, and it seems as if that will continue to be the case.

Alternately, if we can break above the 1.3650 level, I think that this market will continue to go much higher, aiming for the 1.50 level over the longer term, and perhaps the next year. The British pound will continue to be affected by the negotiations between the United Kingdom and the EU, which seemed to be just about wrapped up. At this point, I think that there is a lot of uncertainty about what happens in the United Kingdom over the next couple of years, but quite frankly I feel that the British pound is a bit undervalued, and most of the pundits that I speak to also feel the same way. In general, I think that if you keep your position size small, you can add as the trade works out in your favor. I anticipate a lot of noise over the next several months, so keep this in mind.

GBP/USD Video 11.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement