Advertisement

Advertisement

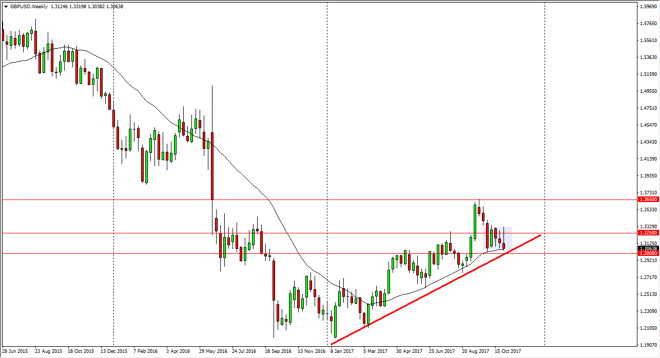

GBP/USD Price forecast for the week of November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:12 GMT+00:00

The GBP/USD pair has rallied significantly during the week, breaking above the 1.3250 level. That’s an area that offered a lot of resistance though, and

The GBP/USD pair has rallied significantly during the week, breaking above the 1.3250 level. That’s an area that offered a lot of resistance though, and with Mark Carney suggesting that the Bank of England wasn’t going to raise interest rates again anytime soon, and that this recent one was an interest rate hike that could be singular, the British pound rolled over drastically to form a shooting star. The uptrend line underneath should offer support, and the 1.30 level underneath is essentially the “floor” in the uptrend. If we were to break down below there, I think at that point we could get a nice selling opportunity going forward, perhaps reaching down to the 1.25 level next. I think that the Mark Carney comments may have been more destructive than we realize, and this next week should tell us exactly how much damage he did.

Alternately, if we were to break above the top of the shooting star, the market could then go to the 1.35 handle, perhaps even the 1.3650 level after that. That is where the market gapped lower after the surprise vote to leave the European Union, and that of course would be a massive bullish sign for the overall currency pair. A break above there should send this market to the 1.50 level above, which obviously will be a major level on longer-term charts. Either way, I think that the market is at a significant inflection point, so if you are at a longer-term trader, you probably need to see it play out over the course of the week, and to see the close for the week. Ultimately, if the market makes a significant move this week, it could become a longer-term trade waiting to happen.

GBP/USD Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement