Advertisement

Advertisement

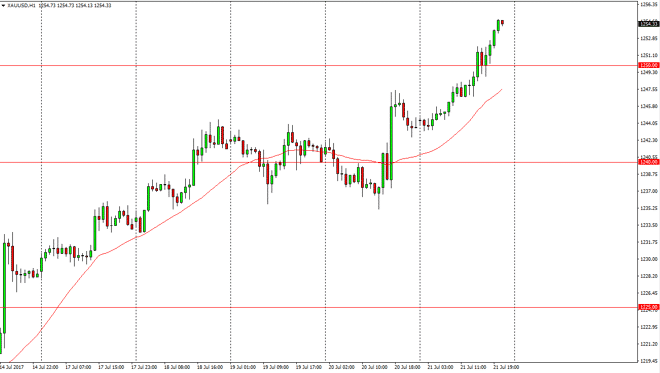

Gold Forecast July 24, 2017, Technical Analysis

Updated: Jul 23, 2017, 10:52 GMT+00:00

Gold markets continue to show bullish pressure during the day on Friday, as we sliced through the $1255 level. This is a very strong sign, and it looks

Gold markets continue to show bullish pressure during the day on Friday, as we sliced through the $1255 level. This is a very strong sign, and it looks very likely that the markets will continue to go higher, perhaps reaching towards the $1300 level on the upside. I believe the pullbacks offer value, and I believe the pullbacks should be supported. I believe that the $1250 level should be essentially a “floor” in this market, and I think that every time we rally it’s time to start taking advantage of what has been a very strong move. The US dollar continues to fall, and that of course works in the favor of precious metals overall, with golden course being the most obvious place to put your money.

Buying pullbacks

I continue to buy pullbacks, as I believe this market as well supported and of course a lot of people are getting very interested. I don’t know if we can break above the $1300 level, but that certainly makes a nice target in the short term. It probably will take a couple of weeks to get there, but eventually I do feel that we are going to reach towards the $1300 level. I believe that a breakdown below the $1250 level would be significantly negative, but I doubt that’s going to happen with very much ease. As long as US dollars on his back foot, and it looks like it could be for a while, gold markets will continue to be one of the major beneficiaries along with stock markets.

Gold Prices Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement