Advertisement

Advertisement

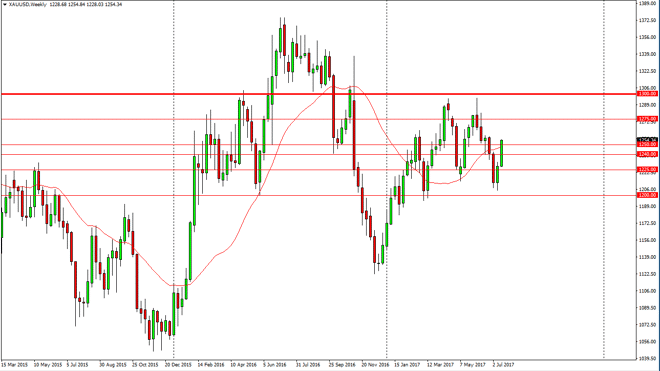

Gold forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:42 GMT+00:00

Gold markets rallied during the week, slicing through the $1250 level, showing signs of real strength. Currently, I believe that the market is essentially

Gold markets rallied during the week, slicing through the $1250 level, showing signs of real strength. Currently, I believe that the market is essentially consolidating between the $1200 level on the bottom, and the $1300 level on the top. I think we’re going to continue to reach towards that area, so therefore I am bullish gold and realize that if we have US dollar weakness, the market should continue to favor gold. I think that a break above the $1300 level will be a bit difficult, but as soon as we break above there, I would anticipate that we are going to the $1350 level. This is a market that should be bought on dips, but will be very volatile to say the least. I think that the markets will continue to see choppiness, but longer-term I think will favor the upside.

Buying dips

I believe in buying dips, but I may have to look towards the short-term charts to find that value. I don’t have any interest in selling unless of course we break down below the $1200 level, which would be very negative. Ultimately, this is a market that is benefiting from the currency markets, and the currency markets are most certainly working against the value of the underlying dollar. I think that the market will eventually make an impulsive move, as we seem to have so much in the way of underlying strength. Gold markets have been choppy, but I think we are simply building up enough momentum to make a move to the upside longer term. If we did breakdown below the $1200 level, I think the market would drop to the $1125 level almost immediately as it would show such a shift in momentum.

Gold Technical Analysis Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement