Advertisement

Advertisement

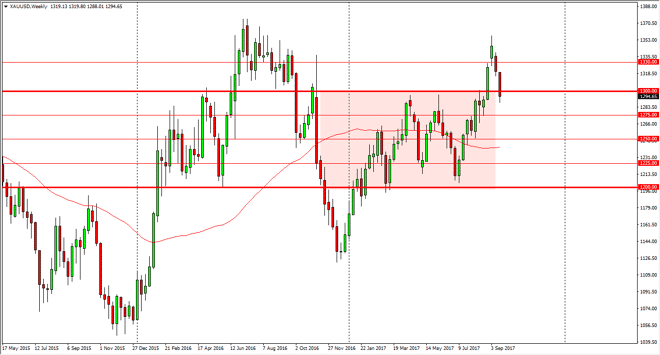

Gold forecast for the week of September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:09 GMT+00:00

Gold markets continue to be very choppy, as we have pulled back completely during the week. We broke below the $1300 level, but quite frankly I think at

Gold markets continue to be very choppy, as we have pulled back completely during the week. We broke below the $1300 level, but quite frankly I think at this point you still need to look at this candlestick as the market retesting an area that a breakout of. If you look at short-term charts, becomes a little bit more apparent that the region between $1290 and the $1300 level is a bit of a sponge for support. Because we remain above there, I think that the buyers still could come back into play. If we get the daily break and close above the $1300 level, that should signal that we are going to continue the uptrend that we had recently been so bullish on.

I believe the pullbacks offer buying opportunities unless we break down below the $1290 level, which could send this market lower. All in all, there are plenty of reason to think that a sudden “risk off” event could happen, and that certainly would work in the favor of gold. The first thing that comes to mind of course is North Korea, as tensions are ratcheting up between the North Koreans and the Americans. It would only take a few misguided words to scare the markets again, although they are showing more resiliency to this mess than they had been. Ultimately, if we do find support here I think that we go looking for the $1375 level, and then eventually the $1400 level. I don’t like shorting this market yet, least not until we break down below the $1275 level from a longer-term traders’ perspective. Short-term traders may be able to, but longer-term traders probably need that level broken to start thinking about shorting gold anytime soon.

Gold Price Predictions Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement