Advertisement

Advertisement

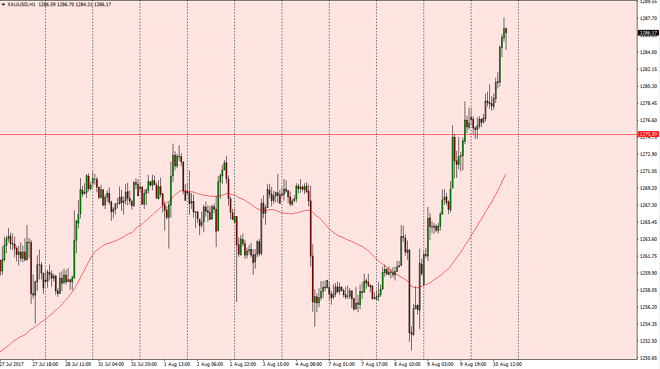

Gold Price Forecast August 11, 2017, Technical Analysis

Updated: Aug 11, 2017, 03:32 GMT+00:00

Gold markets exploded to the upside during the session on Thursday, as we continue to go looking towards the top of the massive consolidation area that

Gold markets exploded to the upside during the session on Thursday, as we continue to go looking towards the top of the massive consolidation area that has been part of this market for some time. That level is the $1300 level, and I don’t think that we get above there unless of course the rhetoric in the Korean Peninsula somehow gets worse. Alternately though, I don’t think that we are going to see much in the way of actual actions though, so I think that once the market settles down and more importantly, the rhetoric settles down, this market should break down rather rapidly. If we do break above the $1300 level, that is going to be a nice buying opportunity as it should enter a “buy-and-hold” phase.

Buyers continue to jump into Gold

I believe that buyers will continue to jump into Gold going forward, mainly because there is so much uncertainty. If the US dollar falls, that will also add a significant amount of pressure in this market. Given enough time, it’s likely that we will see this pressure abate, but right now there are no signs of it. Because of this, I think that the real fight is near the $1300 level above, and that being the case I think that it’s very likely we will see a significant amount of choppiness rather soon as we are getting close to that level. By the end of the day, I think we will have some answers as to what we are going to do about the $1300 level, so I imagine that the close of the session on Friday will be vital, so come back to FX Empire tomorrow to see my analysis on what I think could be a very significant move.

Gold Price Predictions Video 11.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement