Advertisement

Advertisement

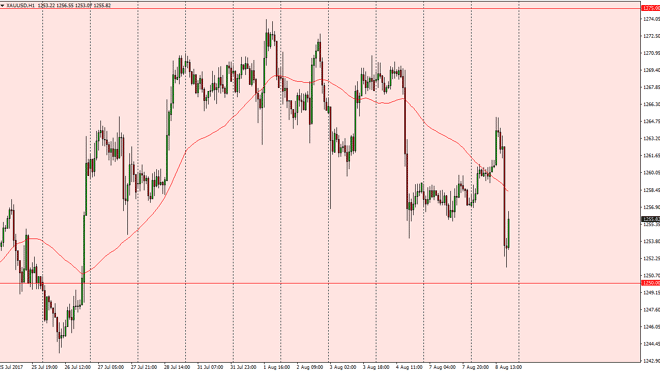

Gold Price Forecast August 9, 2017, Technical Analysis

Updated: Aug 9, 2017, 05:05 GMT+00:00

The gold markets initially tried to rally on Tuesday, but found enough resistance at the $1265 level to turn around and fall significantly. This was in

The gold markets initially tried to rally on Tuesday, but found enough resistance at the $1265 level to turn around and fall significantly. This was in reaction to a stronger than anticipated Jolts figures coming out of the United States, showing that there are over 6 million jobs available in America. This should have the Federal Reserve looking to raise interest rates even more likely, and that of course has sent the value of the US dollar to the upside. Ultimately, this is a market that will be highly influenced by the value of the US dollar and what the Federal Reserve may or may not do.

$1250, the mid-level

I believe that the $1250 level underneath is essentially the middle point of overall consolidation. Because of this, and the fact that we are starting a bounce from there, I suggest that we may see a little bit of a pullback from the massive selloff. However, if we break down below the $1250 level, I feel that the market will probably go looking towards the $1225 level over the next several sessions. The larger consolidation area is $1300 level above, with the $1200 level below. This market should continue to see a lot of choppiness, but I believe it is at the mercy of interest rate expectations currently, and therefore any information about the Federal Reserve will be parsed very closely by traders around the world.

Gold Outlook Video 09.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement