Advertisement

Advertisement

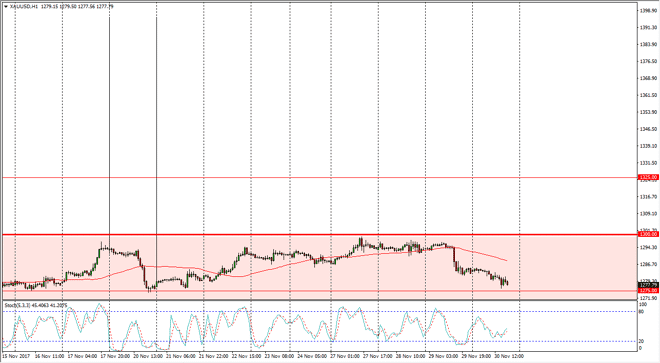

Gold Price Forecast December 1, 2017, Technical Analysis

Updated: Dec 1, 2017, 04:10 GMT+00:00

The gold markets continue to be range bound, although we were a bit negative during the Thursday session. We are testing support, and we will wait to see when the buyers come back.

The gold markets went sideways initially on Thursday, but as you can see drifted a little bit to the downside, reaching towards the $1275 level. That’s an area that’s been very supportive, and because of this I’m waiting to see whether we get some type of bounce to start buying. However, if we break down below the $1275 level with any type of significance, we could get a move down to the $1250 level, which is essentially “fair value” of the longer-term consolidation that we have seen. I would point out that longer-term, we have seen higher lows, and that of course is a very bullish sign. Nonetheless, this is a longer-term bullish sign, and we could get a lot of noise in the meantime.

If we were to turn around, I believe that the $1300 level above is massively resistive, and ultimately a break above there would be a very big sign, and have people looking towards the $1325 level. That area has been resistance in the past, but I think a significant break above the $1300 level should send a lot of fresh money into this market, but would also more than likely need to be accompanied by a shrinking US dollar. Ultimately, I believe that a lot of people are holding onto physical gold, and therefore once this market pops, we could see a lot of buying pressure. In the meantime, it would not surprise me at all to see a little bit of a pullback though, because this has been a longer-term base building exercise over the last several months. Gold markets are slow to move, but once they do momentum typically shoots to the moon right away.

Gold Price Predictions Video 01.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement