Advertisement

Advertisement

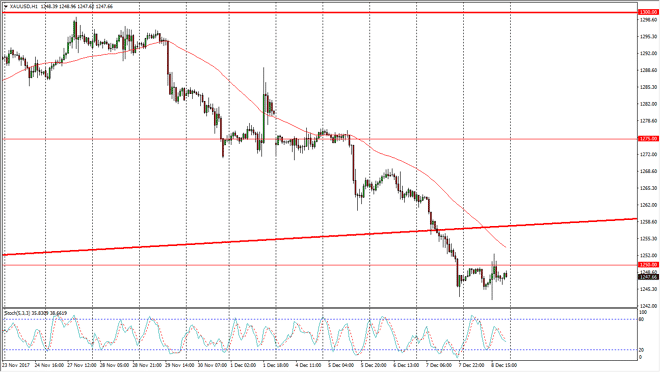

Gold Price Forecast December 11, 2017, Technical Analysis

Updated: Dec 9, 2017, 08:03 GMT+00:00

Gold markets were reasonably quiet during the jobs number and beyond on Friday.

Gold markets went back and forth during the trading session on Friday, testing the $1250 level for resistance. Breaking above there is a bullish sign, but we have a significant amount of resistance above, as we have recently broken down below the uptrend line on the weekly chart. Because of this, I think we may have more downward pressure than up, but if we were to break above the $1260 level, then I think that the gold markets probably go looking towards the $1275 level. A breakdown below the $1243 level is a continuation of bearish pressure in this market just waiting to reach towards the $1225 handle, and then possibly even the $1200 level which is the bottom of the range for the past 12 months. This is a market that continues to be driven by the US dollar more than anything else, and as the Federal Reserve looks likely to raise rates, it has put bearish pressure on gold. We will have to see what the interest rate statement looks like, because if it is hawkish, that would continue to be very bearish for gold, and perhaps to break things down. However, at that very same statement is a bit more dovish than anticipated, gold should turn around rather drastically. I think over the next couple of sessions though, we will be sideways with a slight downward tilt.

Another thing you need to pay attention to is geopolitical concerns, as the Middle East is starting to flare up, we have issues with North Korea as usual, and many other things that could have money flowing into the precious metals markets for safety. In general, I believe that most of the influence will be coming from the Federal Reserve though.

Gold Prices Video 11.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement