Advertisement

Advertisement

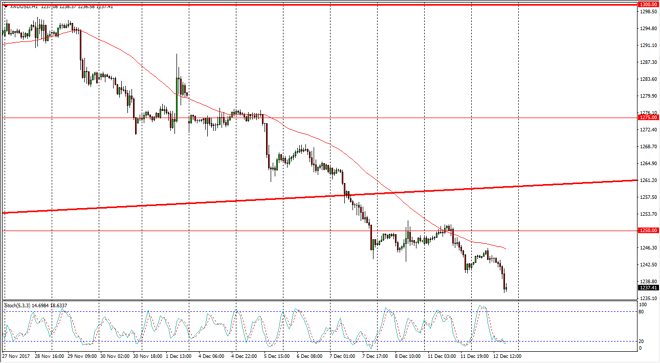

Gold Price Forecast December 13, 2017, Technical Analysis

Updated: Dec 13, 2017, 06:12 GMT+00:00

Gold markets fell initially during the trading session on Tuesday, but have turned around to rally a bit later as the dollar positive effects of a higher than anticipated CPI reading waned.

I believe that the gold markets will be reasonably quiet during the trading session between now and the Federal Reserve announcement, which is going to give us an idea as to where the Federal Reserve is looking next. If we have a hawkish attitude coming out of the Federal Reserve during the interest rate statement, it’s likely that we will see the gold market selloff. We are below the $1250 level, which is essentially “fair value” in the gold markets longer-term, so a breakdown below there is a negative sign. However, I think that we could go much lower, perhaps down to the $1225 level if we get an overly hawkish statement coming out the Federal Reserve.

The alternate scenario of course is that the Federal Reserve is much more dovish than anticipated, and a break above the $1250 level could send this market looking towards the previous uptrend line at the $1260 level, which should be slightly negative. A break above there sends this market much higher, and then has marketplace looking for much higher levels. I think that would shock the market, and the move could be brutal and quick. In general, though, I suspect that waiting for a daily close is probably the best way to deal with what I think will be one of the most interesting markets during the trading session.

Keep in mind that there is a lot of question marks out there when it comes to the Federal Reserve, but I think that given enough time the need to be a bit clearer as to whether attitude is, and although the interest rate hike is expected during the day, it’s the attitude that will be more important in the statement.

Price of Gold Video 13.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement