Advertisement

Advertisement

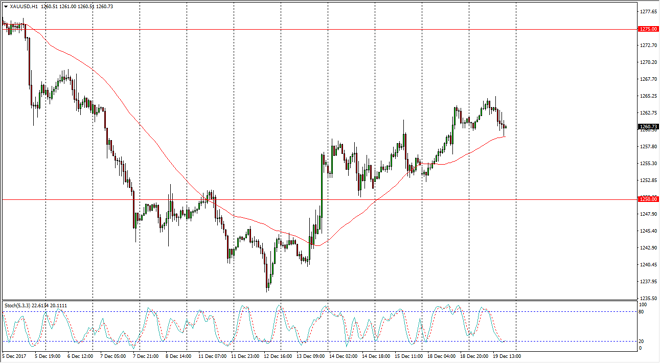

Gold Price Forecast December 20, 2017, Technical Analysis

Updated: Dec 20, 2017, 05:55 GMT+00:00

Gold markets continue to be very noisy, initially rally during the day on Tuesday, but pulling back towards the $1260 handle. The market continues to be noisy, but quite frankly I think we are starting to see more of a bullish attitude towards gold.

Gold markets look likely to be very noisy over the next several sessions, but I think that the $1250 level on the short-term charts should continue to offer support, and I think if the US dollar continues to fall, it’s likely that you will continue to go upside in the gold market. However, there are a lot of noisy areas above, and I think that the initial target will probably be the $1275 level above. If we can break above there, then the market should go much higher, perhaps reaching towards the $1300 level above, which is a longer-term target of mine going into 2018.

If we can break above the $1300 level, the market should go much higher, perhaps reaching towards the $1500 level after that. That is a longer-term goal for gold traders from what I can see, and that could take quite a while to get there. I think that holding onto physical gold is probably the best way to play this market, that way you can mitigate the leverage risk that comes with the futures market. However, if you could trade the CFD markets, you can also add very slowly. Futures markets will probably be difficult because of the volatility but longer-term I think that the buyers will have their say. If we were to break down below the $1225 level, I would expect that would be a massive bearish move just waiting to happen. Keep your position size small initially, and then add as things work out in your advantage.

Gold Outlook Video 20.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement