Advertisement

Advertisement

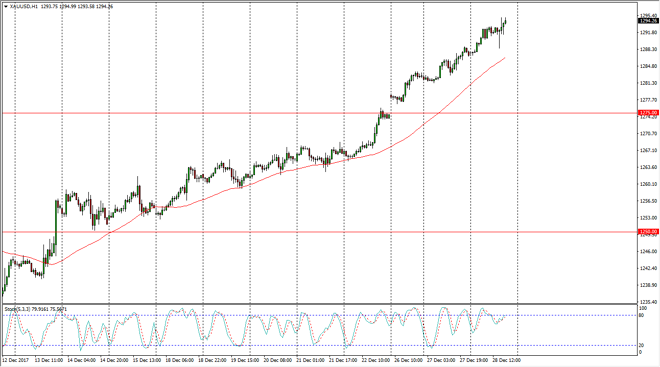

Gold Price Forecast December 29, 2017, Technical Analysis

Updated: Dec 29, 2017, 04:54 GMT+00:00

Gold markets have rallied during the trading session on Thursday, which is no surprise as we have been very bullish over the last several sessions. Beyond that, the US dollar has been beaten up, and that almost always elevates the price of gold as well.

Gold markets have been very bullish of the last several sessions, gapping 3 days ago above the $1275 level. By doing so, it has put a bit of a “floor” in the market at that level, and I think it’s only a matter of time before the gold markets reach towards the vinyl $1300 level. A break above there should send this market much higher, but I think in the short term the $1300 level will probably offer resistance. Breaking above there is a very bullish sign, and could send this market as high as the $1325 level. I think once the traders get back from holiday, we will probably see more volume jump into the marketplace, and continue to go in the favor of gold itself.

Pullbacks towards the $1275 level offer buying opportunities, but with the very thin trading conditions during the holidays, you would be better off adding slowly, thereby mitigating some of the risk that you could face. I believe that if we were to break down below the $1275 level, that could be relatively negative and send this market back towards the $1250 level which has essentially been “fair value” over the last several months. In general, I’m a buyer based upon not only moving averages, but also the US dollar falling in general. I believe that 2018 is going to be very positive for gold, and we are starting to see market participants placed themselves in line for next year’s gains.

Gold Outlook Video 29.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement