Advertisement

Advertisement

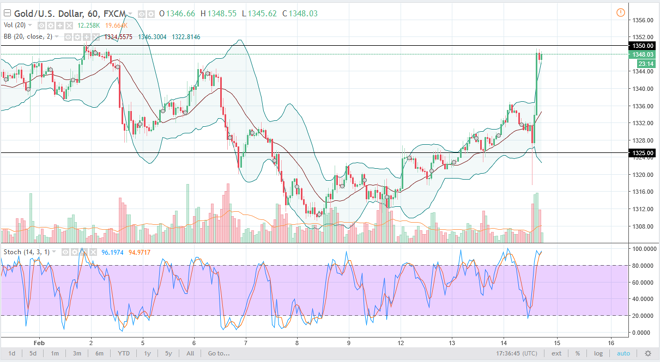

Gold Price Forecast February 15, 2018, Technical Analysis

Updated: Feb 15, 2018, 04:50 GMT+00:00

Gold markets have been very volatile during the trading session on Wednesday, after the CPI numbers have shocked the market, but as you can see we have turned around and reached towards the $1350 level.

Gold markets had a very volatile over the last several days, with Wednesday being especially volatile. We broke down below the $1325 level to find plenty of buyers, and then explode towards the $1350 level. If we can break that level, then the market will go and challenge the $1400 level above, which for me is a barrier for a longer-term buy-and-hold type of move. Ultimately, I believe that the market participants will continue to favor the upside, and I believe that the $1325 level will offer a bit of a floor. If we were to break down below there, that would be very negative for the gold markets, but I believe that the US dollar weakness will continue. Ultimately, I think that once we break above the $1400 level, it will bring in a flood of volume, and send this market much higher. At that point, I would fully anticipate the gold could go as high as $1800 this year, perhaps even $2000. Obviously, volume would need to pick up, but I think it would be a significant enough to break out that the buyers will get a very aggressive.

If we broke down, I believe that the $1300 level underneath is the next support level, but it would be very difficult to break down below there. Either way, this is a market that continues to find plenty of reasons to go higher based upon currency headwinds and of course a struggling US dollar. The gold markets will continue to offer protection from the volatility that we have seen for some traders, and at this point I think there are far too many reasons that think that gold will rise.

Gold Price Forecast Video 15.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement