Advertisement

Advertisement

Gold Price Forecast January 12, 2018, Technical Analysis

Updated: Jan 12, 2018, 04:57 GMT+00:00

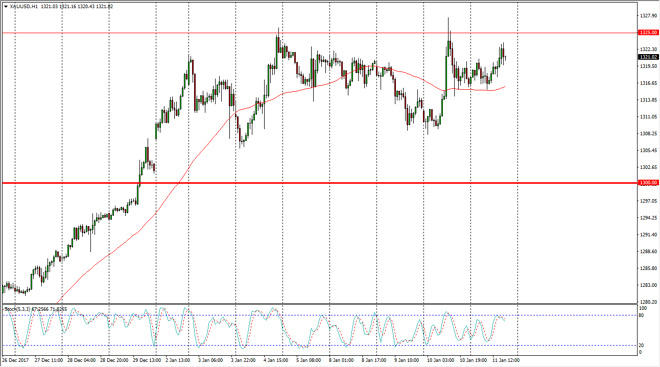

Gold markets continue to be choppy, but ended up finding buyers towards the end of the day. The $1325 level above is looming large, and I believe it’s an area that I think if we can break above there, the market should continue to go higher. That makes the next 24 hours very important.

Gold markets went sideways initially during the trading session on Thursday, but then reach towards the $1325 level above, an area that offered resistance. If we can break above the top of that area, I think that the market will continue to go towards the $1350 level, and then eventually higher than that. Ultimately, I think that short-term pullbacks offer buying opportunities, and that the $1300 level underneath is the “floor.” I also recognize that the market is going to be highly sensitive to what goes on with the US dollar, which seems to be struggling again during the Thursday session.

Longer-term, I think there is a significant amount of bearish pressure on the US dollar, and that should eventually push gold markets higher. I would be a bit careful with leverage though, because gold markets can chop around quite wildly. I think that adding slowly in the CFD market, or perhaps buying physical silver might be the way to go. After all, although gold has been bullish over the last year or so, it has been a very choppy affair to reach the levels that we are at currently. However, if we were to break down below the $1300 level, that would be a negative sign in probably have this market looking towards the $1275 level after that. Expect a lot of noise, but I would expect a lot of dips that offer buying opportunities overall.

Gold Price Predictions Video 12.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement