Advertisement

Advertisement

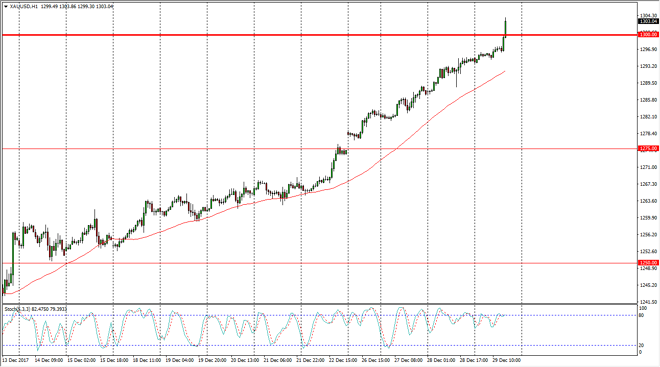

Gold Price Forecast January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:14 GMT+00:00

Gold markets broke out during the trading session on Friday, slicing through a massive barrier at the $1300 level. Ultimately, this is a market that looks like it is ready to go too much higher levels this year.

During Friday session trading in thin volume, Gold markets broke above the $1300 level, which is a psychologically resistant level. We have been very bullish of the longer term, and I think that with the US dollar falling in general, it’s likely that we will continue to see gold markets rally. The US dollar has been getting pummeled after the tax plans were released, and in general this is been a very “risk on” type of marketplace, as currencies around the world continue to outperform the greenback, and it’s likely that the gold markets are moving mainly because of this rather than anything else.

Gold markets also can react to geopolitical concerns, so it’s likely that eventually we will get some type of headline that could also propel gold markets higher. With that in mind, I believe that it is only a matter of time before the markets have yet another reason to go higher. I believe in buying on dips, and I think that the $1290 level will now offer significant support. Precious metals in general are doing quite well, and I think they are going to continue to push each other to the upside in concert also. If we were to break down below the $1290 level, the market could go to the $1280 level next, and then the $1275 level which has a nice gap in it, which can offer the “basement” for the uptrend that we have seen. For now, I’m targeting the $1325 level above. Expect volatility, but this only offers opportunities to add to your position.

Gold Price Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement