Advertisement

Advertisement

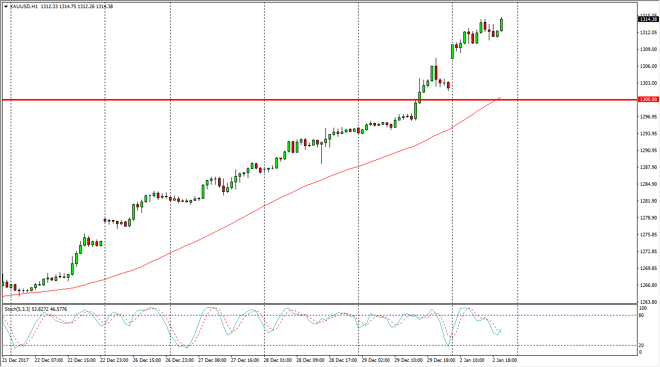

Gold Price Forecast January 3, 2018, Technical Analysis

Updated: Jan 3, 2018, 07:10 GMT+00:00

Gold markets gapped higher at the open on Tuesday, and then continue to go even higher. This is a market that should now find plenty of support at the $1300 level, as the markets have clear the top of a significant resistance barrier.

Gold markets have gapped at the open on Tuesday, and then shot towards the $1315 level. I believe that short-term pullbacks are going to be nice buying opportunities, and that the $1300 level underneath will be massive support. I would be surprised if we broke down below there, as it would show complete reversal of a significant move higher. The US dollar has been on its back foot for some time now, and this looks likely to continue to be the case. With that, it makes sense that the gold markets will continue to find buyers. The marketplace will continue to be volatile, but I believe that dips give you an opportunity to find plenty of value in a marketplace that has been relentless in its drive higher. With that being the case, adding slowly in building a huge core position over the next year is how I plan to trade the market. That doesn’t mean that it won’t be difficult at times, but obviously this is a “buy only” market.

We had recently broken above the top of an ascending triangle, and have been in an uptrend in channel for the last year. There are far too many reasons to think that we are going to continue to go higher, and with the US dollar looking so soft against the Euro, Australian dollar, Canadian dollar, British pound, and many others, it’s likely the gold will continue to get picked up in terms of greenbacks going forward. I fully anticipate on seeing the gold markets reach towards the $1325 level in the next couple of sessions.

Gold Price Video 03.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement