Advertisement

Advertisement

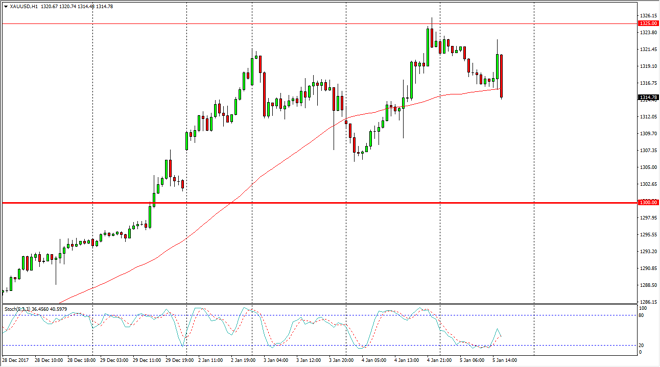

Gold Price Forecast January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:46 GMT+00:00

Gold markets fell during the trading session on Friday, rallied after the jobs number, and then started to fall again. It looks as if the market is trying to pull back a bit, but I think it’s only a matter of time before we find buyers underneath looking for value. After all, there will be a certain US dollar negative bias out there to push precious metals higher over the longer term.

Gold markets were very choppy during the Friday session, as one would expect, as it is the Nonfarm Payroll announcement A. The fact that we have seen so much in the way of volatility should offer buying opportunities below, and I think that it’s only a matter of time before we break down above the $1325 level, which is a large, round, psychologically significant number. By breaking above that level, gold markets will be willing to go to the $1350 level. I think that the $1300 level below remains a very important, and I think it’s only a matter of time before the buyers look at this market as being “cheap.”

If we did breakdown below the $1300 level, it would of course be a very negative sign, and at this point it would be an invitation to start selling. Until we break down below there though, I think it’s likely that the buyers will continue to find plenty of value in this market. If we continue the upward pressure, I have longer-term targets of $1400, and beyond. I think that adding on these dips offers an opportunity to build a large core position, as the trend is most decidedly positive over the last several months. I believe that the US dollar is starting to soften against most currencies around the world, and that of course will lift precious metals as well.

Gold Prices Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement