Advertisement

Advertisement

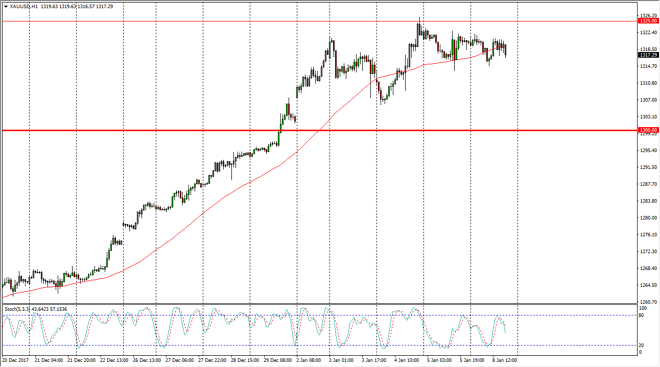

Gold Price Forecast January 9, 2018, Technical Analysis

Updated: Jan 9, 2018, 03:12 GMT+00:00

Gold markets were a bit choppy during the trading session on Monday, as we continue to see a lot of noise. The $1325 level above is massive resistance, and I think it’s only a matter of time before we break above there. However, in the short term we are starting to see a bit of US dollar strength, and that works against the value of gold in general.

I like buying gold in dips, and this chart is a perfect example as to why. We continue to pull back slowly, and occasionally, offering a bit of value. If you add to your goal position slowly, you can ride out a lot of the volatility that is inherent in this market. I would direct your attention to the gap just above the $1300 level, because I think that is the most important sign of bullishness on the chart. The $1325 level above is going to continue to offer resistance, but it has been broken before, and it certainly will be broken again.

With Monday being a bit of a “risk off” situation, the US dollar rallied and that of course is negative for gold in general. I believe that the market will of course continue to be very noisy and sensitive to the greenback, but in general I think it’s obvious that the gold market is bullish overall. I think that once we break the $1325 level, the market probably goes to the $1350 level after that. The marketplace is very noisy, but that’s typical for gold. The US dollar has been weak for a while, so it makes sense that the uptrend continues over the longer term. Add slowly to a core position, and in small increments as the futures markets could be dangerous, however holding physical gold or even small bits and pieces in the CFD market allows for more flexibility and to take advantage of the longer-term movement.

Gold Price Video 09.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement