Advertisement

Advertisement

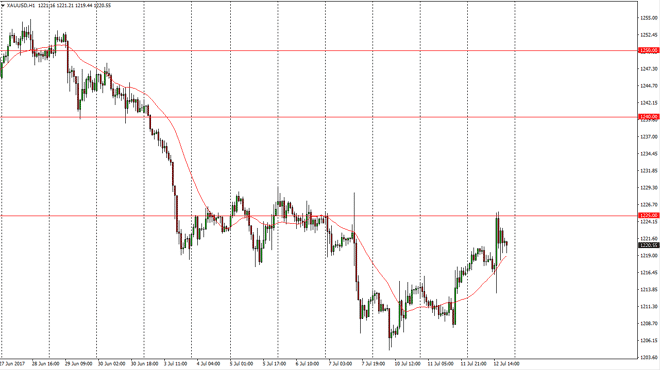

Gold Price Forecast July 13, 2017, Technical Analysis

Updated: Jul 13, 2017, 11:54 GMT+00:00

Gold markets initially spiked to the upside, slamming into the $1225 level. The market turned around though, and it now looks as if gold is going to

Gold markets initially spiked to the upside, slamming into the $1225 level. The market turned around though, and it now looks as if gold is going to continue to be very soft. I think that gold sellers will continue to step into this market, it’s not until we break above the $1230 level that I would consider buying. In the meantime, I think that rallies are to be sold, which is exactly what we are seeing on the hourly chart. I think the market is going to go looking towards the $1200 level, which is a massive support level on longer-term charts. Below there, gold markets will break down significantly and go looking for a more significant bottom, perhaps the $1000 handle which I see as vital on the monthly chart.

The Alternate Scenario:

The alternate scenario would be a breakout to the upside and above the $1230 level. If we get that move, the market should then go looking for the $1240 level above which should be resistive. The markets will be volatile regardless what happens, but longer-term we are bearish, and I think that will continue to be the case given enough time. This market should continue to offer plenty of opportunities, but I believe that the lack of explosive follow-through during the session on Wednesday after the initial surge tells just how negative this market is over the longer term. The fact that we could not rally on Wednesday is a very bad sign for the longer-term range and trend of the market, so I believe that sellers are going to become very aggressive at the first hint of being able to be so. I remain a seller rallies, unless of course we break above the $1230 handle, which I think will take a significant amount of effort.

Gold Price Forecast Video 13.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement