Advertisement

Advertisement

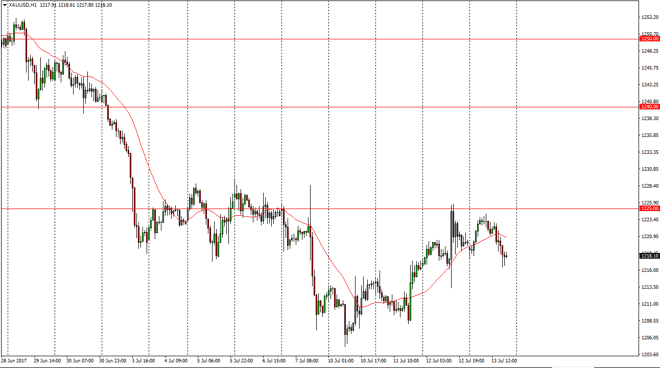

Gold Price Forecast July 14, 2017, Technical Analysis

Updated: Jul 14, 2017, 05:29 GMT+00:00

Gold markets initially tried to rally during the session on Thursday, but found enough resistance at the $1225 level to roll over and fall significantly.

Gold markets initially tried to rally during the session on Thursday, but found enough resistance at the $1225 level to roll over and fall significantly. It looks as if we are going to continue to see selling opportunities on short-term rallies, and that is how I’m going to play this market. If the US dollar picks up value, and it looks like it could, that will continue to weigh upon the gold markets as well. I currently believe that there are a lot of traders out there looking to push this market to the $1200 level to see if they can break it down. If it does break down there, the market goes much lower. If that happens, I think that the longer-term sellers will come into this market and jump in with both feet.

The alternate scenario…

I believe that there is an alternate scenario to pay attention to, and that would be breaking above the $1230 handle. Once we break above there, the market probably goes looking for the $1240 level. I doubt that’s going to happen, but it is a scenario that we must be paying attention to. I think the $1240 level will be massive resistance as well, so it’s likely that any rally will be a short-term opportunity at best. I prefer to sell this market overall, as the longer-term trend certainly dictates lower prices. In fact, if we can break below the $1200 level, I feel that the market will probably go down to the $1100 level, possibly even $1000 longer term. Pay attention to the US dollar, this market is going to correlate in the opposite direction as we typically see. Central bankers will continue to push gold around, and the more hawkish they sound, the worst this market is going to do.

Gold Price Predictions Video 14.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement