Advertisement

Advertisement

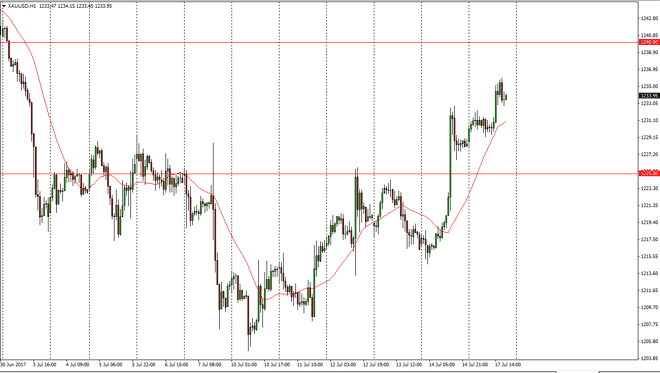

Gold Price Forecast July 18, 2017, Technical Analysis

Updated: Jul 18, 2017, 06:36 GMT+00:00

Gold markets rallied on Monday, using the 24-hour exponential moving average as support. It looks like the markets going to go looking for the $1240 level

Gold markets rallied on Monday, using the 24-hour exponential moving average as support. It looks like the markets going to go looking for the $1240 level above, now that we have clear the $1230 level. The market tends to move incrementally like that, and with the Federal Reserve looking very dovish, at least in comparison to previous announcements and meetings, it looks as if gold will continue to get support. I think that the gold markets are going to reflect this, as the US dollar has been getting pummeled.

Buying dips

Continue to buy dips in this market, as I believe there is plenty of reason to think that the US dollar gets sold off and of course this always seems to benefit the gold markets when it comes to fears about interest rates. I think that a break above the $1240 level could happen, and when it does the market is probably going to go looking for $1250 next. That’s not to say that this will be an easy and quick move, just that it will be bullish overall. Adding to winning positions is probably the best way to trade this market, because quite frankly it does get rather volatile. I have no interest in selling, least not until we break down below the $1220 level, something that I don’t see happening in the short term. Market participants continue to bet on a shrinking US dollar, and that is going to continue to put a bit of a floor in this market.

Gold Analysis Video 18.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement