Advertisement

Advertisement

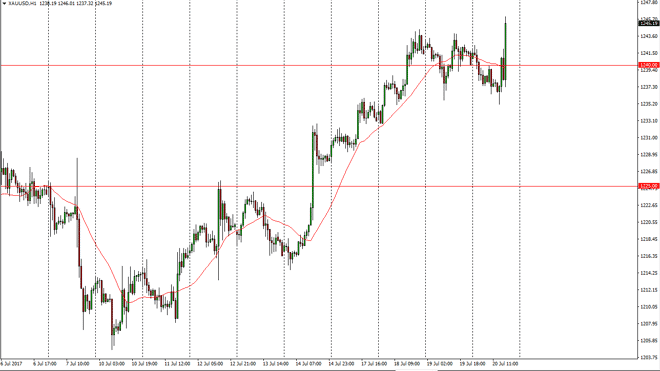

Gold Price Forecast July 21, 2017, Technical Analysis

Updated: Jul 21, 2017, 05:28 GMT+00:00

Gold markets were slightly negative at the beginning of the session on Thursday, but then spiked through the $1240 level as it was announced that the

Gold markets were slightly negative at the beginning of the session on Thursday, but then spiked through the $1240 level as it was announced that the investigation into Donald Trump was expanded. This wasn’t because of anything that has been found, rather that there are global companies that he owns that could have had dealings with Russia in the past. The markets overreacted in my estimation though, and therefore I don’t know if the gold markets are going to just slice through the $1250 level. I expect there should be a significant amount of resistance and that psychological barrier, so I would refer to look at this market is one that you can buy on the dips as we have shown in impulsivity to the upside, but we honestly have a lot of noise just waiting to happen.

Buying dips

I believe that buying dips will be the best way to go going forward, and I don’t necessarily want to buy at the top of an impulsive candle. I think the gold will continue to go higher for other reasons than Donald Trump, mainly that people are starting to bet that the Federal Reserve will not be willing to raise interest rates as rapidly as once thought. Because of this, I think that the $1235 level should now offer a bit of a floor in a market that looks to be bullish longer-term and although very choppy, looks very likely to retain its bullish overall attitude.

Gold Price Predictions Video 21.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement