Advertisement

Advertisement

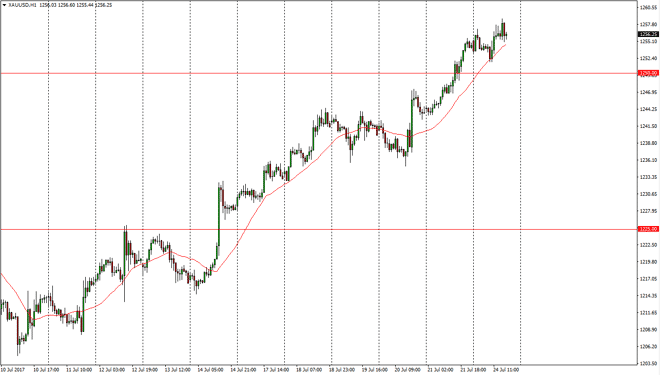

Gold Price Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:14 GMT+00:00

Gold markets initially fell on Monday, but found enough support just above the $1250 level to bounce and break above the $1255 level. It now looks as if

Gold markets initially fell on Monday, but found enough support just above the $1250 level to bounce and break above the $1255 level. It now looks as if the markets are trying to go higher, and I believe it’s only a matter of time before the buyers get involved when we pull back. Pullbacks should represent value, as the US dollar is in a lot of trouble, and the gold markets of course are a quick way to play against the dollar weakness in general. I believe that the $1250 level should be massively supportive, and essentially a “floor” in the market as we should continue to see a general running away from the greenback.

Dips offer value

Dips should continue to offer value, and I believe that it is not until we break down below the $1250 level that the idea of the uptrend turning around can even be remotely entertained. Quite frankly, even that isn’t necessarily a reason to start selling, and I believe that gold will continue to try to rally, perhaps aiming for the $1260 level and the short-term, and then longer-term looking for the $1280 level above which is a much more interesting level on longer-term charts. That’s not to say that it will be an easy trade to take, and certainly volatility will be part of the gold market, but it certainly looks as if the buyers are in control and I certainly wouldn’t want to go against that type of bullish trend.

Gold Price Video 25.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement