Advertisement

Advertisement

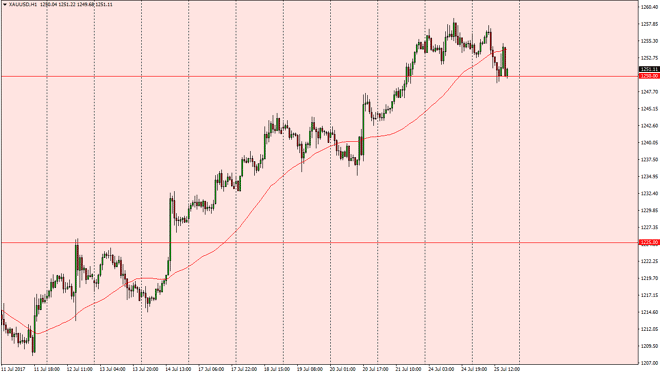

Gold Price Forecast July 26, 2017, Technical Analysis

Updated: Jul 26, 2017, 04:41 GMT+00:00

Gold markets have been volatile to say the least on Tuesday, reaching down towards the $1250 level where they found support. With today being FOMC

Gold markets have been volatile to say the least on Tuesday, reaching down towards the $1250 level where they found support. With today being FOMC Statement day, it’s likely that we will see a significant amount of volatility in this market. Because of this, I would be very careful about getting involved until after the reaction is known. Although the market has been favoring the upside as of late, the Federal Reserve could be very hawkish, or suggested that perhaps interest rate hikes are still coming in the same manner as people had thought months ago, and that could turn this market right back around. Because of this, I think that the precious metals market is probably one of the most dangerous ones to be involved in.

Waiting for the daily close

I believe that the best way to trade this market is to wait for the daily close, to see where we are. If we break down below the $1240 level, I think that the market will probably continue to drift lower. However, if we break out above the $1260 level, I believe that the market will continue to go towards the $1300 level which at the moment is my longer-term target. However, the FOMC can change all of that in a blink of an eye, so I’m not prepared to put money to work in the short term as it is simply gambling and taking a guess as to where the market could end up going next.

Price of Gold Video 26.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement