Advertisement

Advertisement

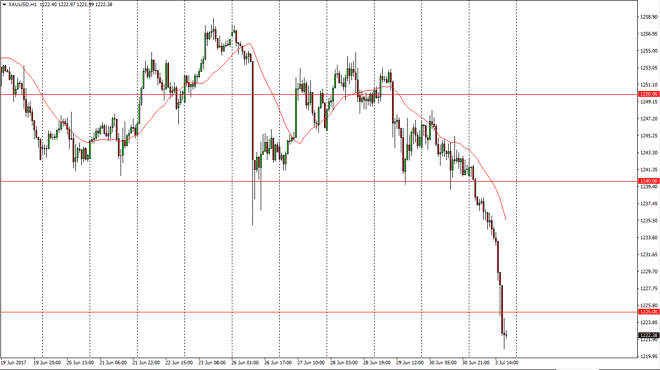

Gold Price Forecast July 4, 2017, Technical Analysis

Updated: Jul 4, 2017, 04:44 GMT+00:00

Gold markets fell apart during the Monday session, slicing through the $1240 level. Not only that, the market reaches down to the $1225 level after that.

Gold markets fell apart during the Monday session, slicing through the $1240 level. Not only that, the market reaches down to the $1225 level after that. The market looks as if it can’t get out of its own way, and with the US dollar strengthening, I think we will continue to see quite a bit of weight upon the gold market. A breakdown below here should then go to the $1200 level after that, which has much more psychological significance than the areas that we have sliced through. The 24-hour exponential moving average has been reasonably important, and I think that may continue to be the case going forward. If we do get a rally from here, I think that the sellers will probably get involved. Quite frankly, it’s not until we break above the $1240 level that I would be willing to buy this market that has been so sold off.

Oversold?

It’s possible that this market is oversold, so a bounce could make quite a bit of sense so that we can bounce to relieve some of the bearish pressure. These rallies typically offer great selling opportunities though, so I think it’s only a matter of time before the bears would jump back in. I think at this point, the market is going to go looking for the $1200 level, but it’s probably going to take a bit of time. Once we get there, the uptrend could be in serious trouble if we break down. Currently, I believe that the $1240 level is trying to offer a bit of a “ceiling”, and will continue to be very difficult to overcome. However, if we did, then I think the market goes much higher, as it would show a real resilience to the market.

Gold Price Video 04.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement