Advertisement

Advertisement

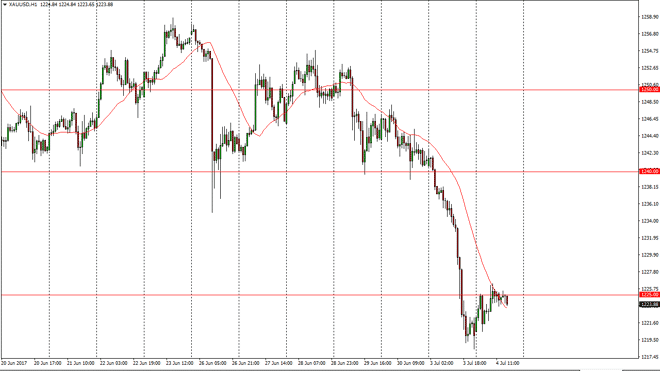

Gold Price Forecast July 5, 2017, Technical Analysis

Updated: Jul 5, 2017, 04:52 GMT+00:00

Gold markets have been volatile during the session on July 4, as the Americans were away at Independence Day holiday celebrations. The gold markets

Gold markets have been volatile during the session on July 4, as the Americans were away at Independence Day holiday celebrations. The gold markets continue to look negative overall, as central banks around the world are trying to tighten. This of course works against the value of gold as the US dollar rallies, and I think that we are going to continue to see selling pressure every time we rally in the precious metal sector. I believe that the $1225 level should offer resistance, and the $1240 level above there should as well. The real target in my estimation is going to be the $1200 level, which is a large, round, psychologically significant number and previous support and resistance.

Liquidity issues

We obviously have some liquidity issues during the day on Tuesday, as Americans were away for Independence Day celebrations. However, I think the longer-term downtrend has started to pick up momentum, and I believe it’s only a matter of time before we get down to the $1200 handle. If we can break down below there, the market could go much lower, and become an extraordinarily bearish market. I think longer-term the gold will recover, because quite frankly there’s too many political issues around the world to think it won’t. However, any type of leverage in the gold market is dangerous, so I would be buying physical gold if anything at this point, or perhaps maybe even a gold related ETF. That of course is a longer-term investment, and not a trade, so most of you will be looking to short this market.

Price of Gold Video 05.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement