Advertisement

Advertisement

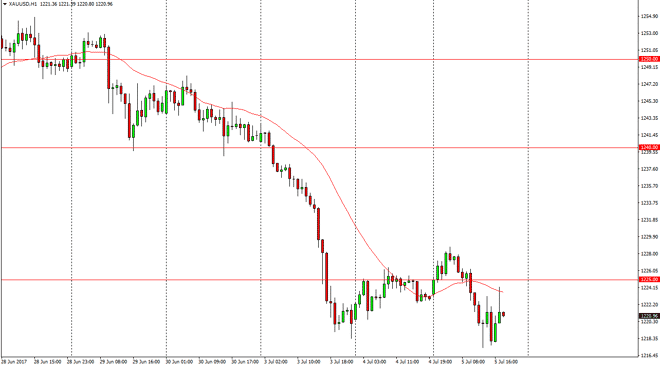

Gold Price Forecast July 6, 2017, Technical Analysis

Updated: Jul 6, 2017, 05:01 GMT+00:00

Gold markets initially tried to rally but then fell apart during the day on Wednesday, but rolled over and broke below the $1225 level. We then broke down

Gold markets initially tried to rally but then fell apart during the day on Wednesday, but rolled over and broke below the $1225 level. We then broke down to the $1217 level before bouncing again. However, the market has been in a downtrend and we have broken down below the bottom of a bearish flag. I think that we will continue to go lower, so I’m looking to sell this market and aim for the $1200 level underneath which I think will be much more substantial as far support is concerned. The $1225 level above should be resistance, and I think that sellers will come back into play once we get to that area. Honestly, it’s not until we break above the $1230 level that I would consider buying this market, and that of course will have to do more with the FOMC Meeting Minutes than anything else.

The minutes will be coming out

Once the FOMC Meeting Minutes are released, it could give Gold markets a bit of a boost if the Federal Reserve looks less likely to raise interest rates than the market time, but quite frankly I think almost everything is priced into the market and therefore we will continue to see bearish pressure on gold markets as not only the Federal Reserve looks likely to raise interest rates, but so do other central banks around the world, or at least tighten monetary policy. That brings down the luster of gold, and therefore I think that we will continue to see the market struggle in general. Geopolitical concerns will probably be the biggest driver of gold if we do go higher, with the special eye being tilted towards the Korean peninsula as the recent missile test shows just how precarious the situation could be.

Gold Price Forecast Video 06.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement