Advertisement

Advertisement

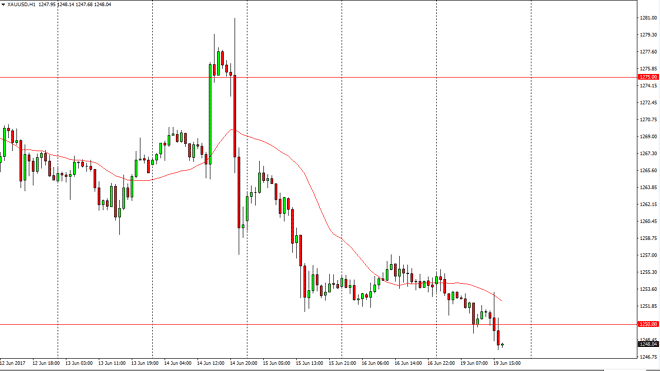

Gold Price Forecast June 20, 2017, Technical Analysis

Updated: Jun 20, 2017, 05:07 GMT+00:00

Gold markets fell during the session on Monday, breaking below the $1250 level. That is a significant psychological number, and the fact that we have

Gold markets fell during the session on Monday, breaking below the $1250 level. That is a significant psychological number, and the fact that we have broken down below there, the market looks very likely to continue to start selling off. The 24-hour exponential moving average has been offering resistance all day, and I believe that the market should continue to go down to the $1225 handle. Alternately, I believe that we not only will reach that area but then go down to the $1200 level after that. Having said that, if we breakdown below the bottom of the range for the day, it is simply a selling opportunity to reach towards the uptrend line on the longer-term charts.

The alternate scenario

The alternate scenario of course is a breakout to the upside, perhaps reaching above the $1257 level. Once we do, then I think the market could rally towards the $1265 level. The goal markets are very sensitive to the US dollar, and if it starts to rally that could continue to push gold markets lower. However, interest rate differentials and interest rate expectations are all over the place right now, so I think the one thing you can count on is that there is going to be a significant amount of volatility in the precious metals markets. Gold can be a bit of a safety play at times, so geopolitical concerns could be a major driver. The markets currently look vulnerable, so rallies continue to be a bit suspicious in my eyes, unless of course something major changes around the world. Political concerns aside, I think that the markets will continue to be choppy regardless, and with that position sizing will be very important.

Gold Price Video 20.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement