Advertisement

Advertisement

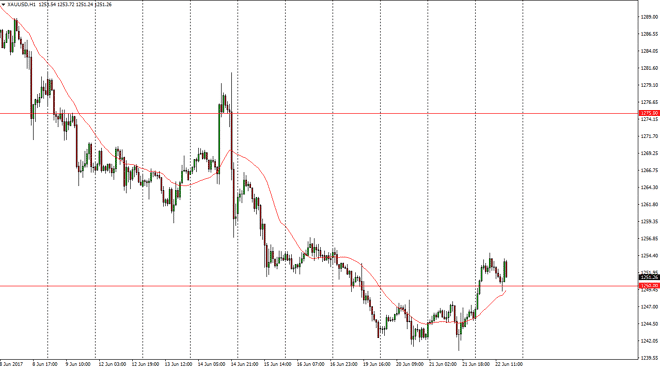

Gold Price Forecast June 23, 2017, Technical Analysis

Updated: Jun 23, 2017, 03:41 GMT+00:00

Gold markets shot higher during the day on Thursday, breaking above the $1250 level. The level is starting to act as support, which is a very technically

Gold markets shot higher during the day on Thursday, breaking above the $1250 level. The level is starting to act as support, which is a very technically bullish sign, and of course the 24-hour moving average is just below trading pricing. I think if the market can break above the $1255 level, the market should continue to go much higher, perhaps reaching towards the $1260 level. A break above there should send the market towards the $1275 level. As long as we can stay above the $1250 level, the market should continue to see bullish pressure over the longer term. That’s not to say that it will be an explosive moved, because it is of course a market that has been breaking down recently, but keep in mind that the gold markets move not only on US dollar weakness, but on geopolitical concerns, of which there could be plenty any time in the short term.

The alternate scenario

The alternate scenario of course is a breakdown below the $1248 level, and that would probably have this market looking for the lows again, and then down to the $1200 level. Longer-term, we have broken down significantly, but this could be the beginning of a turn around. Again though, I don’t have any interest in buying until we break above the $1255 level, and more importantly, stay above it for a couple of hours or perhaps even the next day. With this being the case, expect quite a bit of volatility, and I do recognize that on longer-term charts there is a massive uptrend line about $20 below where we are now, so a breakdown is still only a short-term trading as far as I can see. Ultimately, volatility is here to stay in the gold market.

Gold Price Predictions Video 23.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement