Advertisement

Advertisement

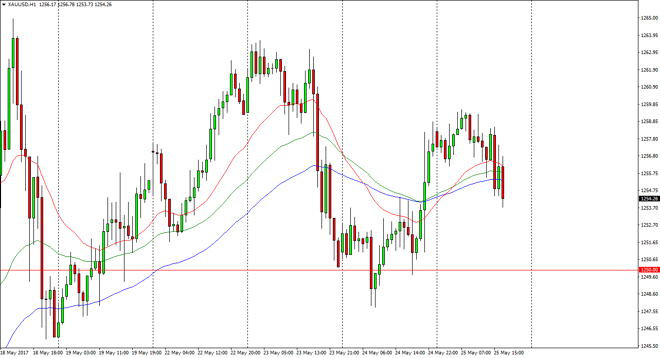

Gold Price Forecast May 26, 2017, Technical Analysis

Updated: May 26, 2017, 04:07 GMT+00:00

Gold markets were originally flat during the day on Thursday, but started to roll over later in the day. Having said that, we are just above significant

Gold markets were originally flat during the day on Thursday, but started to roll over later in the day. Having said that, we are just above significant support at the $1250 level, so I think it’s only a matter of time before the buyers come back into the marketplace and start supporting gold again. This market pulling back is just a continuation of the consolidated of and choppy nature that the market has been in. I think that the $1250 level underneath will be significant, so I believe that the market continues to find plenty of reasons to go higher based upon headlines, but that’s not to say that the road higher will be rocky.

Geopolitical headlines

Geopolitical headlines will continue to be a significant driver of gold going forward, and I believe that the real threat is probably to the upside rather than the down. However, if we broke down below the $1250 level, we could go fishing for support somewhere near the $1240 level. Longer-term, I believe that this market may try to reach toward to the $1300 level but right now I think that is going to be choppy and difficult to trade this market for a longer-term move. This pullback should offer value the traders are looking for, but wait for a bounce in order to get involved as the market has been so drastically volatile. Perhaps buying smaller positions to begin with might be the best way to go, as you gradually build up the size of your position as it goes in your favor. The US dollar has been a bit soft as of late, and that quite often can help gold as well. Money management and position sizing will probably be your best friend when it comes to trading this market.

Gold Price Predictions Video 26.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement