Advertisement

Advertisement

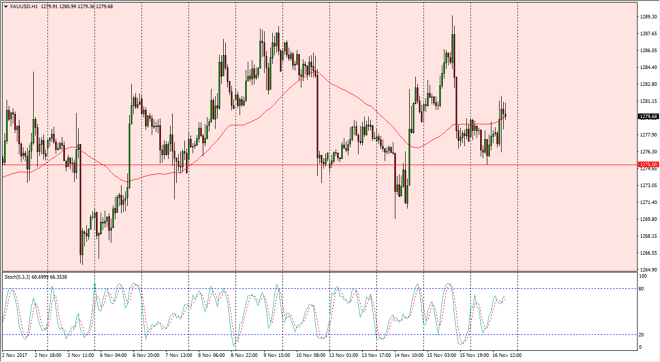

Gold Price Forecast November 17, 2017, Technical Analysis

Updated: Nov 17, 2017, 05:00 GMT+00:00

Gold markets went sideways initially during the trading session on Thursday, bouncing from the $1275 level. This area continues to be important in

Gold markets went sideways initially during the trading session on Thursday, bouncing from the $1275 level. This area continues to be important in general, as the markets have been moving in $25 increments, and the volatility has been extreme. This is a short-term trading market overall, and I think that the $1300 level above should continue to be a target, but should also be thought of as massive resistance. There are a lot of concerns globally, and of course gold gets a little bit of a bid after geopolitical situations, but right now it seems as if the markets are simply dying in this vicinity. Right now, it appears that the $1275 level is essentially “fair value”, so much like the silver market, I believe that we are trading in a “reversion to the mean” type of attitude. If we do break down far enough, we could test the $1250 level, but it’s very unlikely that we break down below there, unless of course the US dollar skyrockets in value.

I suspect that small positions will be the best way to trade this market, in a range bound type of situation, using a range bound system. Gold markets will continue to be difficult because we know that the Federal Reserve is going to raise interest rates, so it needs some type of catalyst to move this market significantly. I don’t think that the market will get that anytime soon, but there’s always the possibility of some type of black swan event coming out of the headlines, and that of course can have gold moving rapidly. Small position sizing is the best way to deal with this market, but if you are a longer-term investor, it’s always nice to hold physical gold as well.

Price of Gold Video 17.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement