Advertisement

Advertisement

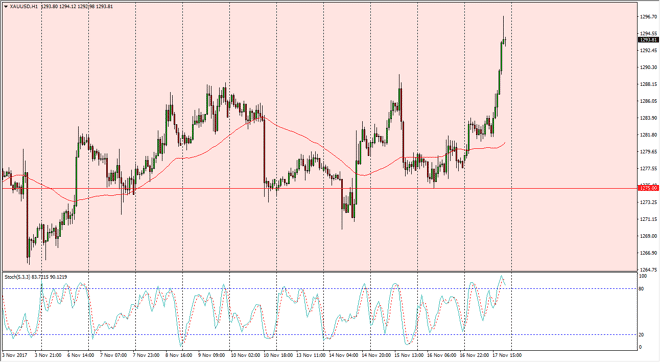

Gold Price Forecast November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:29 GMT+00:00

Gold markets went sideways initially during the day on Friday, and then exploded to the upside, breaking above the $1290 level. However, it looks as if

Gold markets went sideways initially during the day on Friday, and then exploded to the upside, breaking above the $1290 level. However, it looks as if the market is going to pull back a bit, as we have gotten overextended. However, that should end up being a buying opportunity as longer-term charts have been grinding their way to the upside. I for look at the $1275 level underneath as support, and I think that we will find buyers on dips and signs of support. If we can break above the $1300 level finally, we should continue to go higher, reaching towards the $1325 level.

If we break down below the $1275 level, that would be a negative sign, perhaps in in the market down to the $1265 level. In general, I believe that the buyers are going to continue to be tenuous, but aggressive simultaneously as the US dollar is struggling to gain against most currencies with the US Congress taking is time to pass a tax bill. As this continues, we should continue to see markets react to headlines coming out of Washington DC, as tax reform is the biggest game in town. The market should continue to be choppy, as there is a lot of noise above, but most certainly a lot of noise below. I suspect, buyers will probably come back in near the $1286 level on the dip, but beware that if a tax bill is passed, we could see this market turn around and break down rapidly.

If you have the ability to buy physical gold and hang onto it, that might be the best way to deal with it, or if not, you may want to trade the CFD markets as it is easier to keep your position low leveraged, unlike the futures market.

Gold Price Forecast Video 20.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement