Advertisement

Advertisement

Gold Price Forecast November 21, 2017, Technical Analysis

Updated: Nov 21, 2017, 05:04 GMT+00:00

Gold markets went sideways initially during the trading session on Monday, as we continue to struggle near the $1300 level. We pulled back to the $1275

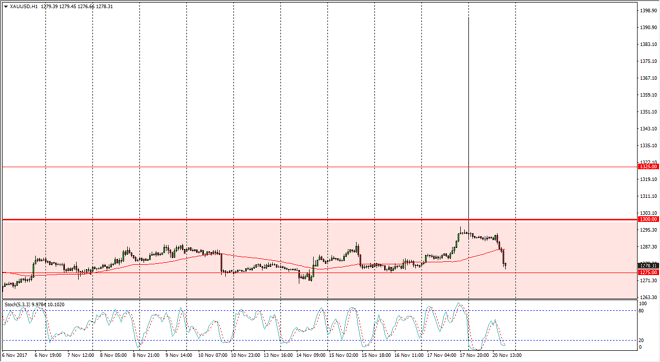

Gold markets went sideways initially during the trading session on Monday, as we continue to struggle near the $1300 level. We pulled back to the $1275 level on the hourly chart, and we are trying to form some type of hammer as I record this. Beyond that, we also have the stochastic oscillator trying to cross in the oversold area, so it could be a short-term buying opportunity. However, I don’t think that we are going to break above the $1300 without some type of external force. Perhaps we can get geopolitical issues to drive a bit of a “safe haven” trade into the goal market, but if we don’t I think that the market will struggle at the $1300 level above, and it should offer a short-term opportunity at best.

Alternately, if we break down below the $1270 level, the market will probably go down to the $1250 level after that, which is even more significant on the longer-term chart, and essentially “fair value” in the larger consolidation area that we have been trading in for some time. The $1200 level underneath is massive support as well, but when I look at the longer-term charts, I can also make out a bit of an uptrend in channel, at least over the last year. I think that if there is some type of shock to the global system, that is what will be needed to see gold take off to the upside with any type of urgency. If we do break above the $1300 level, it’s likely that we could go to the $1325 level after that. That area has been resistive in the past, but also has been a very strong target over the last couple of years, so that would be the next move anticipated.

Gold Outlook Video 21.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement