Advertisement

Advertisement

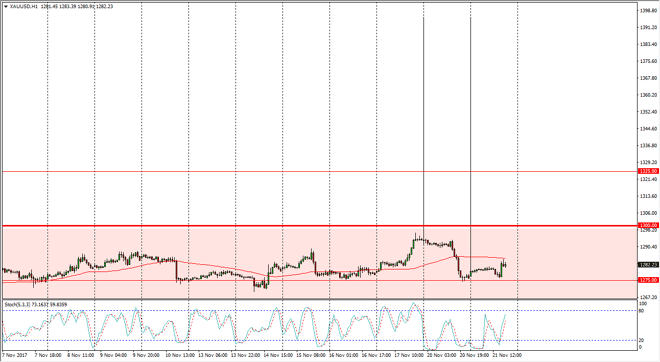

Gold Price Forecast November 22, 2017, Technical Analysis

Updated: Nov 22, 2017, 05:18 GMT+00:00

Gold markets continue to be very choppy, using the $1275 level as support. I think that the $1300 level above will continue to offer significant

Gold markets continue to be very choppy, using the $1275 level as support. I think that the $1300 level above will continue to offer significant resistance though, and with no real catalyst to move the gold markets anytime soon, I think that we are essentially stuck in a very short-term type of trading scenario. The market is essentially stuck between the $1300 level on the top and the $1275 level on the bottom. I think that we continue to look likely to grind back and forth, and the stochastic oscillator could be a reasonable indicator to use to show oversold and overbought condition, but those could also be found in rather easily at the previously mentioned levels.

If we were to break out above the $1300 level, the market then likely goes to the $1325 level. That would be more resistive, and I think at this point we should continue to see volatility with more of an upward bias longer-term, but clearly you can go back and forth, and I think much like in the Silver markets we are going to need to see some type of external force to move out of this range. A lot of geopolitical concerns could come into place, and it’s likely that it will be needed to move between now and the end of the year. As we approach the holiday season, it’s very unlikely that traders are willing to take on large positions in a market that seems to essentially be stuck. If we were to break down below the $1275 level, the market probably drops to the $1250 level which I think is even more support. Over the last year, we have rose steadily, but for every 2 steps forward we take, we take one backwards. I think that continues to be the case.

Gold Outlook Video 22.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement