Advertisement

Advertisement

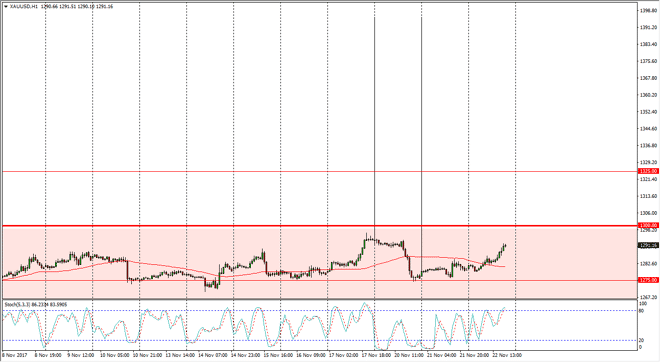

Gold Price Forecast November 23, 2017, Technical Analysis

Updated: Nov 23, 2017, 05:01 GMT+00:00

Gold markets continue to hang about in the same region that they have for about 10 days now, as the $1300 level seems to be a bit too expensive for gold

Gold markets continue to hang about in the same region that they have for about 10 days now, as the $1300 level seems to be a bit too expensive for gold traders, while the $1275 level offers massive support. I’ve been using the stochastic oscillator on the hourly chart, to signify where to go next. If we can break above the $1300 level, it’s likely that we go to the $1325 level after that. Ultimately, if we can break above there, then I think the gold markets are free to go much higher, but we are going to need to see some type of geopolitical issue or sell off in the US dollar to drive the price of gold higher. Ultimately, I think that the market will remain volatile but in a relatively tight trading range.

If we were to break down below the $1275 level, I think the market could breakdown to the $1250 level which has been important in the past. I think that the market continues to be difficult to handle, at least from a longer-term perspective. However, if you have the ability to trade short-term back and forth range bound situations, this might be a good market for you. With the Americans being away for the next 48 hours, that it course is going to hurt liquidity and therefore I think that there needs to be some type of massive geopolitical event to break out. I suspect that the next couple of sessions are going to be more of the same, and I don’t think anything’s going to change until next week. If you have the ability to stick to the short-term charts, gold could be profitable in the meantime, as we await some type of larger catalyst.

Gold Price Video 23.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement