Advertisement

Advertisement

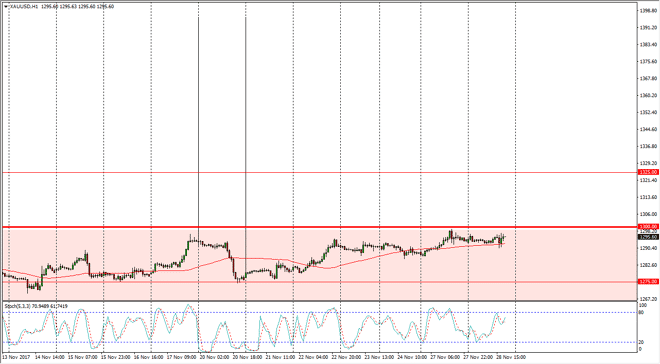

Gold Price Forecast November 29, 2017, Technical Analysis

Updated: Nov 29, 2017, 09:41 GMT+00:00

The gold markets have been sideways in general, as we continue to bounce around underneath the $1300 level. The $1300 level of course is massively

The gold markets have been sideways in general, as we continue to bounce around underneath the $1300 level. The $1300 level of course is massively resistive, and it’s not until we break above there that I feel buying gold is possible, unless of course we get some type of significant pullback. I look at the $1275 level underneath as a bit of a “floor” in the market, and I believe that it’s only a matter of time before we revert to volatility. We don’t have any now though, and it looks likely that we will have to wait to see not only some type of volume, but more importantly momentum. A break above the $1300 level for a couple of hours would have the market looking for the $1325 level above which has been resistance in the past. On signs of exhaustion, you could start to sell gold and reach towards the $1275 level, and a breakdown below there would be a move towards the $1250 level after that. That is “fair value” in the market from the longer-term standpoint as we have been consolidating between $1200 on the bottom and $1300 on the top longer term.

The greenback continues to be very noisy due to tax-free form not being completed anytime soon, and that continues to be one of the major issues facing US dollar buyers, which of course has a knock-on effect in the precious metals market. As the US dollar falls, that typically means that gold will rally, and that’s how I look at this market, the “anti-dollar” trade. Until we get some type of clarity out of Congress, it’s going to be difficult to see a sustained move, but the longer this takes, the more likely it is to favor cold.

Price of Gold Video 29.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement