Advertisement

Advertisement

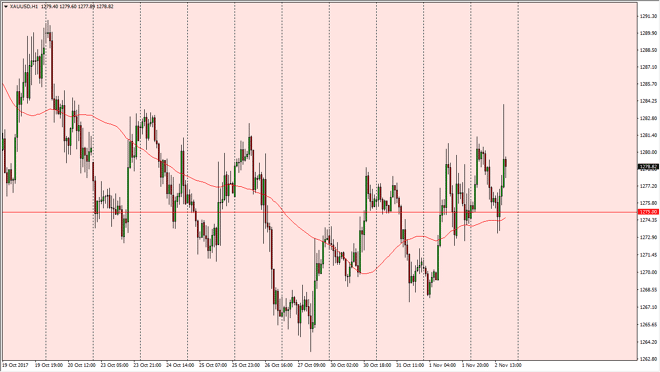

Gold Price Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:18 GMT+00:00

Gold markets had a choppy session on Thursday, which of course makes a lot of sense considering that the jobs number comes out today. The jobs number of

Gold markets had a choppy session on Thursday, which of course makes a lot of sense considering that the jobs number comes out today. The jobs number of course has a massive influence on the US dollar, which by extension has a massive influence on precious metals in general. I believe that the $1275 level underneath is a bit of a median price for the market right now. As we are not seeing stability as of late, I think that short-term trading is probably about as good as this market gets, and I think a move above the $1282 level should be a signal that we could go to the $1300 level. That is an area that is massively resistive, so I would not be surprised at all to see the sellers come back once we reach that level. Between now and the announcement, it’s likely that the market continues to chop around rather wildly.

It would not be a bad idea to sit on the sidelines and wait to see whether we can make an impulsive move, which more than likely will continue to fade away. Overall, the market should continue to be difficult to deal with, so I think that the market needs to probably be traded with either no leverage, or perhaps options markets, as going into the futures market will be very tricky and difficult. You will find yourself in massive trouble rather quickly if the market moves against you.

If we were to break above the $1300 level, the market is likely to go much higher. If we are to break down below the $1250 level underneath, that would be an extraordinarily negative sign for the gold market. Overall, this is a market that is very sensitive to the jobs number, so pay attention to what the US dollar does as the inverse correlation should hold.

Price of Gold Video 03.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement